As markets wrapped up on September 23, 2025, Indian indices showed resilience amid global uncertainties. However, volatility crept in. Let’s break it down. First, we’ll cover the day’s highlights. Then, we’ll explore price movements. After that, global influences come into play. Moreover, technicals and sectors offer deeper insights. Finally, strategies and levels guide tomorrow’s trades. Throughout, we’ll use data from reliable sources like NSE India and Moneycontrol to back our analysis.

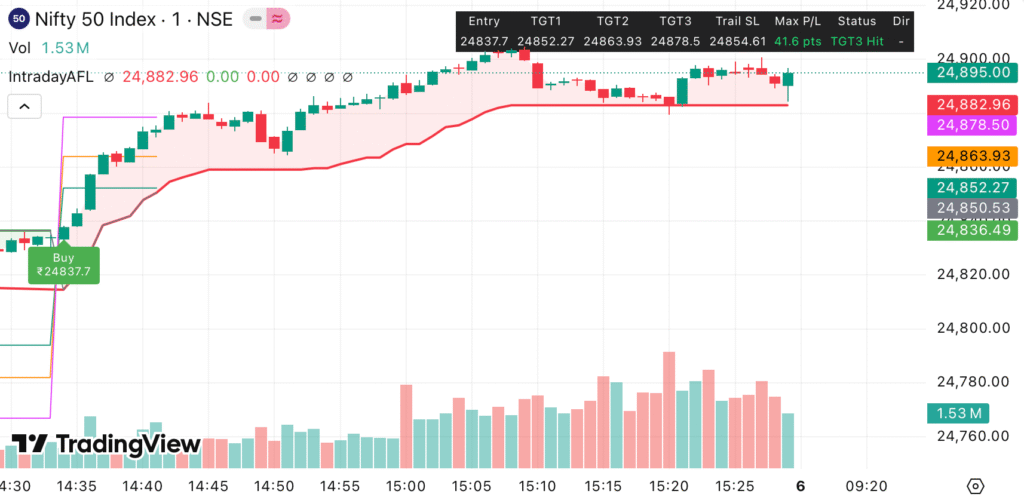

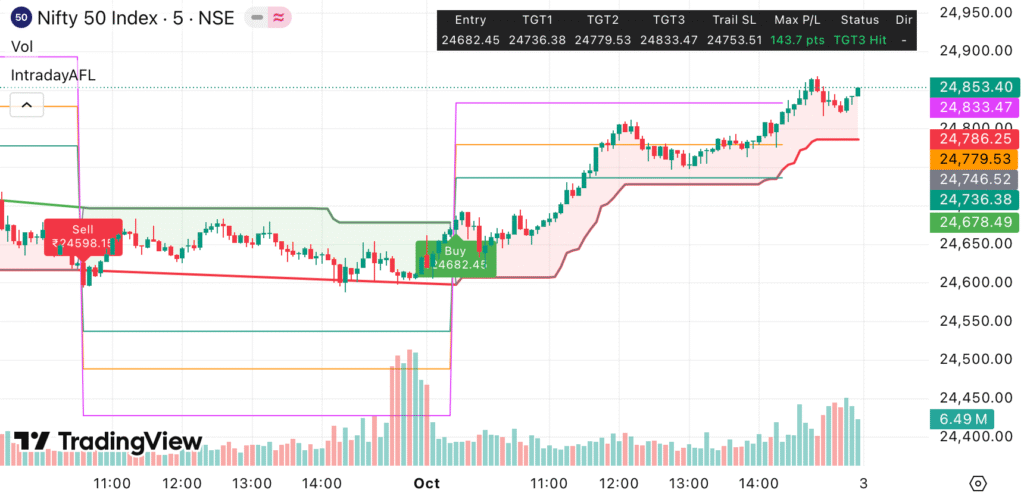

This post-market review aims to equip traders with actionable ideas. Whether you’re into intraday plays or swing setups, we’ve got you covered. Plus, check our Free Buy-Sell Chart for real-time signals. For advanced tools, explore the TradingView Indicator. And if high-reward options appeal, join our Hero Zero Option Calls with 2-5X Profit/Call.

Now, let’s dive in.

Key Takeaways

Markets ended mixed on September 23, 2025. For instance, Nifty 50 closed slightly lower. Meanwhile, Bank Nifty held steady. Volatility rose modestly, signaling caution. Additionally, IT stocks dragged the indices down. On the positive side, banking and metals provided support. Overall, the session reflected consolidation. Therefore, traders should watch key supports closely. In summary, while bears tested lows, bulls defended crucial zones. This sets up an intriguing day ahead.

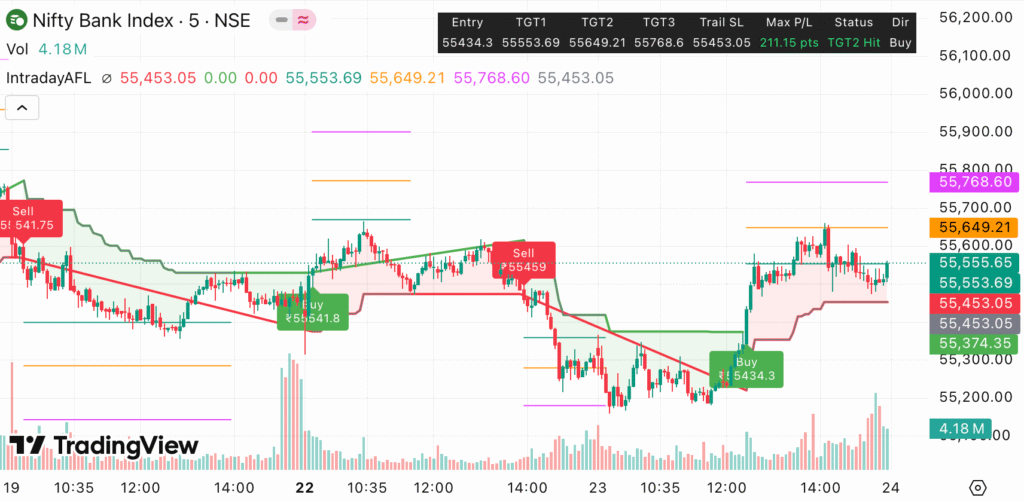

First, Nifty 50 settled at 25,169.50, down 0.13% or 32.85 points. Similarly, Sensex dipped 57 points to close lower. Bank Nifty ended at 55,284.75, down 0.31%. However, intraday recoveries showed buyer interest. For example, Nifty rebounded from 25,085 to test 25,246. Likewise, Bank Nifty swung between 55,143 and 55,624. Moreover, India VIX climbed to 10.63, up 0.66%. This indicates rising fear, but it’s still low historically.

Sector-wise, IT fell sharply due to H-1B visa concerns. Conversely, PSU banks and metals gained. Globally, mixed cues from Asia and Europe influenced sentiment. Thus, the day highlighted defensive plays. Looking ahead, focus on 25,150 support for Nifty. If it holds, upside potential emerges. Otherwise, deeper corrections loom. In essence, these takeaways underscore a market in flux. Stay tuned for detailed breakdowns.

To enhance your trading, integrate our Free Buy-Sell Chart. It offers live signals for better decisions.

Price Action Breakdown (Nifty and Bank Nifty)

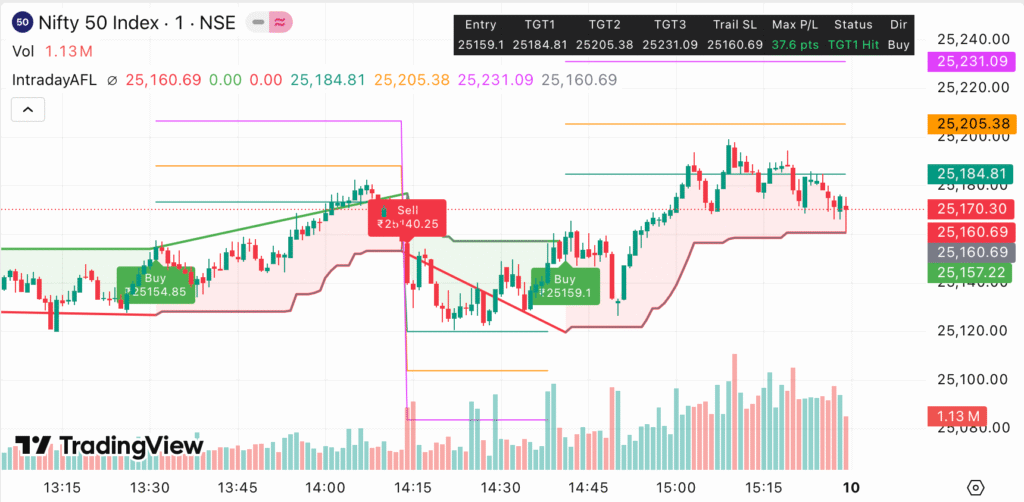

Price action on September 23, 2025, revealed telling patterns. For starters, Nifty 50 opened lower at 25,238.10. Then, it climbed to 25,331.70 intraday. However, selling pressure emerged. As a result, it dipped to 25,151.10 before closing at 25,169.50. This formed a bearish candle with a long upper shadow. Moreover, it respected the 25,150 support. Therefore, the session suggested consolidation rather than a breakdown.

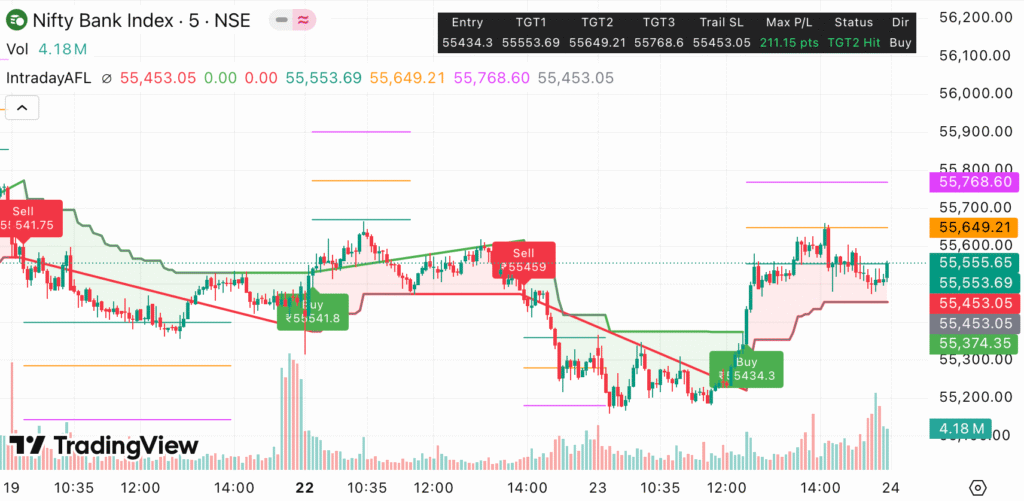

Meanwhile, Bank Nifty mirrored this caution. It started at 55,429.30 and hit a high of 55,648. But then, it retreated to 55,233. Finally, it settled at 55,284.75, down modestly. Interestingly, it formed an indecision doji. This indicates balanced forces. Additionally, volumes were average at 254.51 million for Nifty. For Bank Nifty, trading stayed range-bound.

Furthermore, both indices showed lower highs compared to prior sessions. For Nifty, resistance at 25,360 held firm. Similarly, Bank Nifty faced hurdles at 55,500. On the flip side, supports like Nifty’s 25,060-25,030 zone acted as buffers. Thus, the price action pointed to a tug-of-war. Bulls defended lows, but bears capped upsides. Consequently, traders eyed volatility spikes.

In comparison, the previous day saw sharper falls. On September 22, Nifty dropped 124.70 points to 25,202.35. Bank Nifty fell 0.48% to 55,458.85. However, September 23 brought stabilization. This shift hints at potential rebounds. Still, with VIX rising, caution prevails. Overall, the breakdown shows a market pausing for direction. For more on patterns, link to NSE’s historical data (outbound: https://www.nseindia.com/market-data/pre-open-market-cm-and-emerge-market).[9]

To visualize trends, use our TradingView Indicator. It simplifies chart analysis.

Global Market and Macro Updates

Global markets set a mixed tone on September 23, 2025. For instance, Asian indices varied. Japan’s Nikkei rose slightly amid yen stability. However, China’s CSI 300 dipped on economic concerns. Meanwhile, European markets like FTSE gained on ECB hints. Additionally, US futures pointed higher after Fed rate cuts. These cues influenced Indian sentiment positively at open.

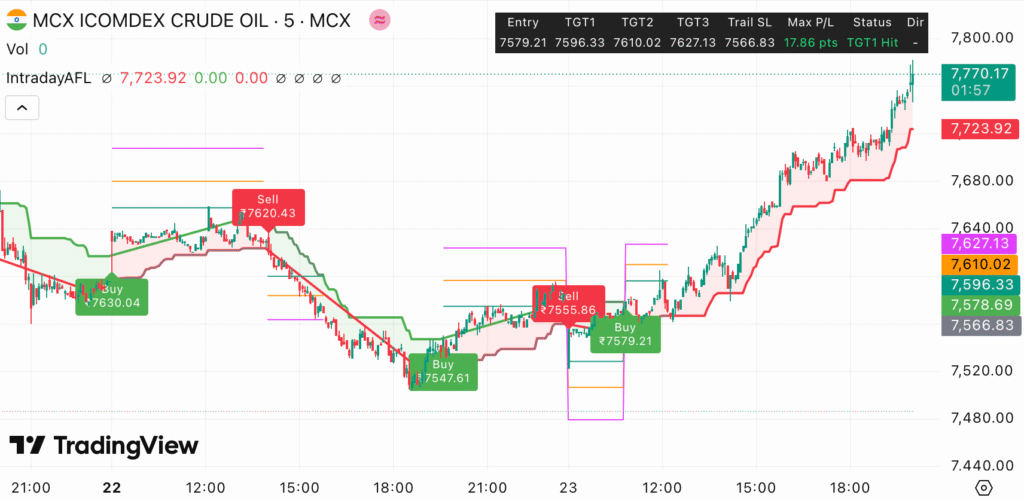

Moreover, macro factors played a role. Oil prices steadied around $71 per barrel, supporting energy stocks. But then, gold surged to $2,620 amid safe-haven demand. Furthermore, India’s rupee held at 83.50 against the USD. This stability aided importers. On the domestic front, GST collections rose 10% YoY, boosting fiscal optimism. However, H-1B visa fee hikes hit IT sentiment hard.

Transitioning to broader updates, FIIs bought Rs 475 crore on September 22. But DIIs sold modestly. Additionally, GIFT Nifty traded lower at 25,235, down 0.04%. This suggested a flat open for September 24. Moreover, US 10-year yields at 3.75% signaled easing. Thus, global liquidity remains supportive.

However, risks linger. For example, geopolitical tensions in the Middle East could spike oil. Similarly, US election uncertainties add volatility. In India, upcoming RBI policy might influence rates. Therefore, macros point to cautious optimism. Bulls benefit from Fed easing, but local drags like IT woes persist. For real-time global news, refer to Bloomberg (outbound: https://www.bloomberg.com/markets).[10]

Technical Indicator Table (RSI, VIX, PCR)

Technicals provide crucial signals for September 23, 2025. Specifically, RSI, VIX, and PCR highlight momentum and sentiment. For Nifty 50, RSI stood at 58.18, indicating bullish yet cautious vibes. Meanwhile, India VIX closed at 10.63, up 0.66%. This shows mild fear creeping in. Additionally, PCR was 0.77, leaning bearish but not extreme.

For Bank Nifty, RSI hovered around 57, suggesting consolidation. VIX applies similarly at 10.63. PCR data was less pronounced, but options OI showed support at 55,000. Overall, indicators point to range-bound action.

Nifty 50 & Bank Nifty Technical Indicators – 23 September 2025

These metrics underscore a market in balance. RSI above 50 supports bulls, but rising VIX warns of swings. PCR below 1 indicates call dominance, potentially capping upsides. Thus, monitor for shifts. For detailed charts, visit Investing.com (outbound: https://in.investing.com/indices/s-p-cnx-nifty-technical).[9]

Sector Performance Table

Sectors drove the day’s narrative on September 23, 2025. Notably, banking held firm with 20.42% weightage. IT, at 12.57%, was the biggest laggard. Energy and autos provided mixed support.

Nifty 50 Sector Performance Table – 23 September 2025

Banking rebounded, led by PSU names. IT plunged on visa news. Metals shone with JSW Steel gains. FMCG faced pressure from HUL. Thus, sector rotation favored defensives. For sector data, check Moneycontrol (outbound: https://www.moneycontrol.com/markets/sector-analysis/).[3]

Trading Strategy for 24/09/25 (Intraday + Swing)

Strategies for September 24, 2025, blend intraday and swing ideas. First, for intraday: Focus on range plays. For Nifty, buy dips near 25,150 with stop at 25,000, targeting 25,300. Similarly, for Bank Nifty, enter longs at 55,200-55,300, stop 55,000, aim 55,800. Use 15-minute charts for entries. Moreover, watch VIX; if above 11, reduce position size.

Transitioning to swing: Hold positions longer. For Nifty, if above 25,200, target 25,500 over 2-3 days. Bank Nifty could rally to 56,000 if 55,300 holds. However, if breaks lower, short towards 25,000 for Nifty. Risk management is key; use 1% risk per trade. Additionally, incorporate options: Buy calls on support bounces.

Furthermore, factor in GIFT Nifty’s flat signal. Avoid over-leverage amid expiry volatility. For high-reward plays, our Hero Zero Option Calls with 2-5X Profit/Call channel delivers timely alerts.

In summary, intraday favors dips, while swing eyes breakouts. Adapt based on open.

Key Levels Table

| Index | Support 1 | Support 2 | Resistance 1 | Resistance 2 |

|---|---|---|---|---|

| Nifty 50 | 25,150 | 25,030 | 25,250 | 25,360 |

| Bank Nifty | 55,200 | 55,000 | 55,500 | 56,000 |

These levels, derived from OI and price action, guide entries. For Nifty, 25,150 is pivotal. Bank Nifty’s 55,000 is key support.

Final Thoughts

September 23, 2025, showcased market resilience. Despite IT drags, supports held. Therefore, September 24 could see rebounds if globals cooperate. However, monitor VIX and macros. In conclusion, stay agile. Use tools like our Free Buy-Sell Chart for an edge.

Disclaimer

Trading involves risks. Past performance isn’t indicative of future results. Consult a financial advisor before acting. Views are for informational purposes only. We aren’t liable for losses. Data sourced from NSE, Moneycontrol, etc..