Key Takeaways

The Indian stock market wrapped up another volatile session on September 22, 2025. Indeed, the Nifty 50 index closed lower, shedding 124.70 points to settle at 25,202.35. This marked a decline of 0.49%. Meanwhile, Bank Nifty followed suit, ending at 55,284.75 with a drop of about 0.48%. However, broader market sentiment remained cautiously optimistic. For instance, sectors like PSU Banks and Realty showed resilience amid global cues.

Moreover, global markets provided mixed signals. The US indices hit fresh highs following the Federal Reserve’s rate cut. Yet, domestic IT stocks faced pressure due to H-1B visa fee concerns. Additionally, the India VIX surged to 10.56, indicating rising volatility. On a positive note, Adani Group stocks extended gains.

Furthermore, technical indicators pointed to bullish undertones. The Nifty’s RSI stood at 63.71, suggesting sustained momentum. PCR values reflected balanced sentiment, with Nifty at 0.57 (OI basis). For traders, key levels around 25,150-25,500 will be crucial for tomorrow.

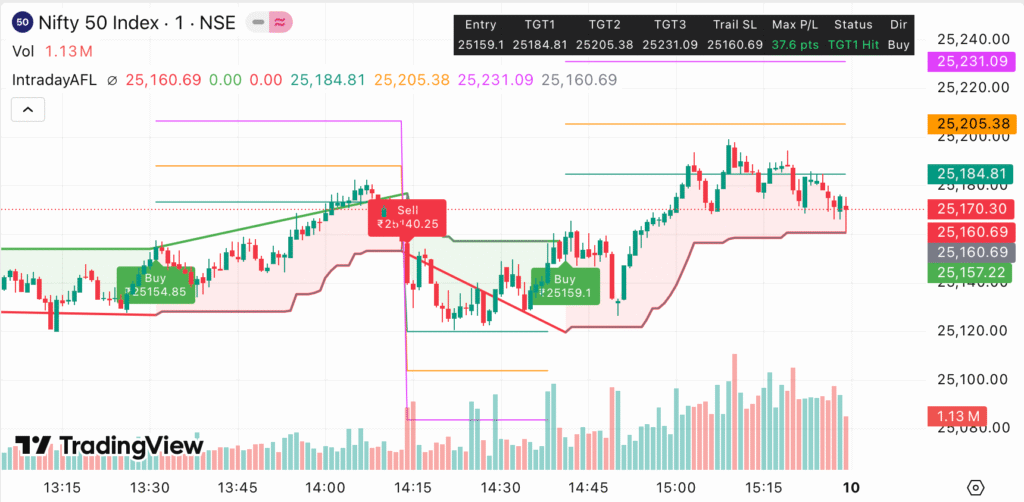

In summary, while today’s dip signals short-term consolidation, the overall trend leans bullish. Therefore, focus on selective sectors for opportunities. Remember, for real-time signals, check our Free Buy-Sell Chart.

Price Action Breakdown (Nifty and Bank Nifty)

Let’s break down the price action for Nifty 50 and Bank Nifty on September 22, 2025. First, the Nifty 50 opened at 25,238.10 but faced selling pressure early on. Consequently, it dipped to an intraday low of around 25,150 before recovering slightly. However, bears dominated the close, pushing it down to 25,202.35—a loss of 124.70 points or 0.49%.

Moreover, volume analysis revealed above-average trading at 380.36 million shares. This suggests institutional participation amid the pullback. In fact, the index respected its 20-day EMA support but closed below the previous session’s high. As a result, it formed a bearish candle on daily charts, hinting at potential consolidation.

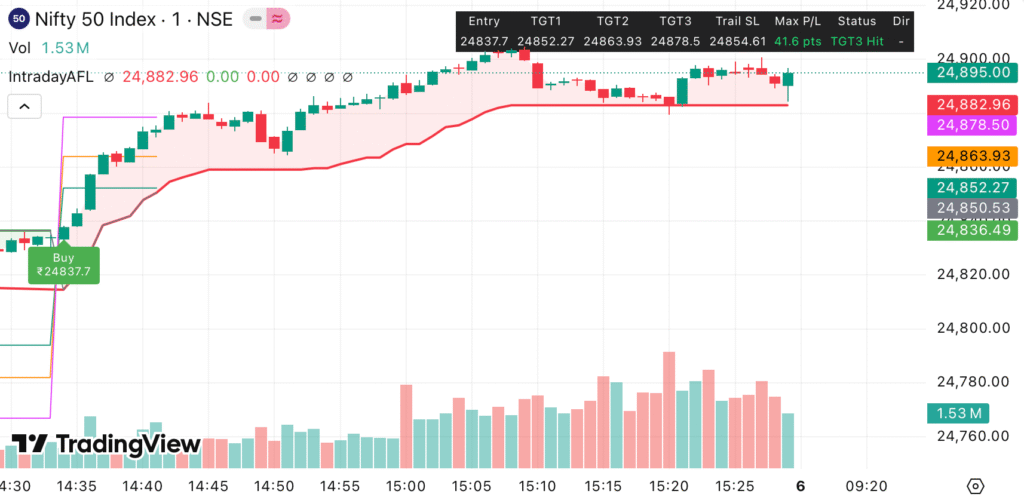

Shifting to Bank Nifty, the index mirrored Nifty’s moves. It started at 55,429.30 and climbed to a high of 55,666.35 before retreating. Ultimately, it settled at 55,284.75, down approximately 0.48%. Notably, private banks underperformed, with Kotak Mahindra Bank closing below its 50-day moving average.

Furthermore, both indices showed negative breadth. For Nifty, advancers lagged decliners, led by IT heavyweights like Infosys and TCS. On the flip side, energy stocks like Adani Green provided some cushion. Overall, the session highlighted profit booking after recent gains. Yet, the dip could set up for a rebound if global cues improve. For deeper insights, explore our TradingView Indicator tools.

To elaborate, Nifty’s price action reflects a classic pullback in an uptrend. Since mid-August, the index has rallied over 10% from lows around 23,000. However, today’s move tested the 25,150 support zone. If it holds, bulls might target 25,500 anew. Similarly, Bank Nifty’s action points to banking sector fatigue, exacerbated by macro headwinds.

In addition, candlestick patterns offer clues. Nifty’s bearish engulfing-like formation warns of caution. But, with the index above all key EMAs (20/50/100/200), the medium-term bias stays positive. For Bank Nifty, the close near 55,000 suggests a potential bounce if it surpasses 55,500 tomorrow.

Global Market and Macro Updates

Global markets influenced Indian indices on September 22, 2025. For starters, US equities reached record highs after the Federal Reserve’s 25 basis point rate cut. Indeed, the S&P 500 and Nasdaq surged, boosted by tech upgrades and deal activity. However, European markets remained flat, with banks gaining but shippers weakening.

Meanwhile, Asian markets were steady. The Hang Seng held flat, while Japan’s Nikkei eased on Bank of Japan’s ETF unwind signals. Additionally, China’s markets showed resilience amid southbound flows.

On the macro front, key events loomed. The US Chicago National Activity Index for August was due, alongside Fed speaker comments. Moreover, Trump’s proposed $100k H-1B visa fee rattled Indian IT firms, triggering a sell-off. This policy aims to curb visas, impacting companies like TCS and Infosys.

Furthermore, the UK, Canada, and Australia recognized Palestine, potentially affecting geopolitics. Closer home, the Indian rupee weakened to 88.32 against the USD, down 22 paise. Oil prices hovered stable, but silver hit 14-year highs on ETF demand.

In other news, the US Senate rejected a funding bill, risking a shutdown by September 30. For more on global impacts, read this Reuters analysis. Similarly, check Investing.com’s take on rate cut effects.

These updates underscore interconnected markets. For instance, Fed’s dovish stance could boost emerging markets like India. Yet, visa woes add uncertainty for IT exports. Overall, macro stability supports bullish bets, but watch PMI data this week.

Technical Indicator Table (RSI, VIX, PCR)

Technical indicators provide vital insights into market momentum. For September 22, 2025, here’s a snapshot for Nifty 50 and Bank Nifty.As shown, Nifty’s RSI at 63.71 indicates bullish but not overbought conditions. The VIX at 10.56 signals moderate volatility. PCR (OI) for Nifty is 0.57, suggesting slight bearish tilt. For Bank Nifty, PCR stands at 0.95, more balanced.

These metrics align with consolidation. For detailed charts, visit Moneycontrol.

Sector Performance Table

Sector performance varied widely for the week ending September 22, 2025. Top performers included PSU Banks and Realty, driven by rate cut hopes.[18]PSU Banks led with 4.83% gains, followed by Realty at 4.43%. Conversely, FMCG and Consumer Durables lagged with negative returns. This highlights rotational plays. For sector news, see CNBC’s overview.

Trading Strategy for 23/09/25 (Intraday + Swing)

Looking ahead to September 23, 2025, let’s outline strategies for intraday and swing trading on Nifty 50 and Bank Nifty. First, for intraday: Focus on range-bound moves. If Nifty holds above 25,150, buy dips targeting 25,300-25,400. Use stop-loss at 25,100. Similarly, for Bank Nifty, enter longs above 55,300, aiming for 55,600 with stops at 55,100.

Moreover, incorporate options. With PCR at 0.57, consider bull put spreads on Nifty for limited risk. For example, sell 25,100 put and buy 25,000 put. However, monitor VIX; if it spikes above 11, shift to neutral strategies like iron condors.

Transitioning to swing trades: The bullish trend persists. For Nifty, accumulate on pullbacks to 25,000-25,100, eyeing 25,700 in 1-2 weeks. Bank Nifty could target 56,000 if it breaks 55,500. Use moving averages for confirmation.

Additionally, sector-specific plays: Go long on Realty and Defence stocks, as per weekly gains. Avoid IT amid visa fears. For high-reward options, join our Hero Zero Option Calls with 2-5X Profit/Call.

Remember, risk management is key. Allocate no more than 2% per trade. For live signals, use our Free Buy-Sell Chart. Stay updated via FXStreet.

Key Levels Table

Key levels guide tomorrow’s trades. Here’s a table for Nifty 50 and Bank Nifty on September 23, 2025.

| Index | Support 1 | Support 2 | Pivot | Resistance 1 | Resistance 2 |

|---|---|---|---|---|---|

| Nifty 50 | 25,150 | 25,100 | 25,250 | 25,400 | 25,500 |

| Bank Nifty | 55,100 | 55,000 | 55,300 | 55,600 | 56,000 |

These levels are based on pivot points and recent highs/lows. Watch for breakouts.

Final Thoughts

In conclusion, September 22, 2025, brought a healthy correction to Nifty and Bank Nifty. Yet, underlying strength persists. Therefore, traders should prepare for volatility but capitalize on dips. Moreover, global rate cuts could fuel further upside. Stay vigilant with tools like our TradingView Indicator.

Disclaimer

This analysis is for informational purposes only. It does not constitute financial advice. Always consult a professional before trading. Past performance is not indicative of future results. We are not liable for any losses incurred.