Key Takeaways

The Indian equity markets concluded a volatile session on September 19, 2025, breaking a three-day winning streak. Meanwhile, profit-booking emerged at higher levels. Moreover, the Nifty 50 declined 96.55 points (-0.38%) to close at 25,327.05. Additionally, the Sensex fell 387.73 points (-0.47%) to settle at 82,626.23.

Furthermore, institutional flows showed mixed patterns. Specifically, FIIs remained net buyers with ₹390.74 crores inflow. Similarly, DIIs demonstrated strong support with ₹2,105.22 crores net buying. Consequently, this institutional backing provides underlying market strength despite short-term volatility.

Importantly, the India VIX dropped to 9.88. Subsequently, this indicates reduced volatility expectations. Therefore, the low VIX suggests market stability ahead. Meanwhile, the Put-Call Ratio (PCR) stands at 0.82, indicating bullish sentiment with call option dominance.

Additionally, the Federal Reserve’s recent 25 basis points rate cut continues supporting emerging markets. However, investors remain cautious about ongoing US-India trade negotiations. Notably, the GST rate cuts effective September 22, 2025, could boost consumption demand significantly.

Price Action Breakdown

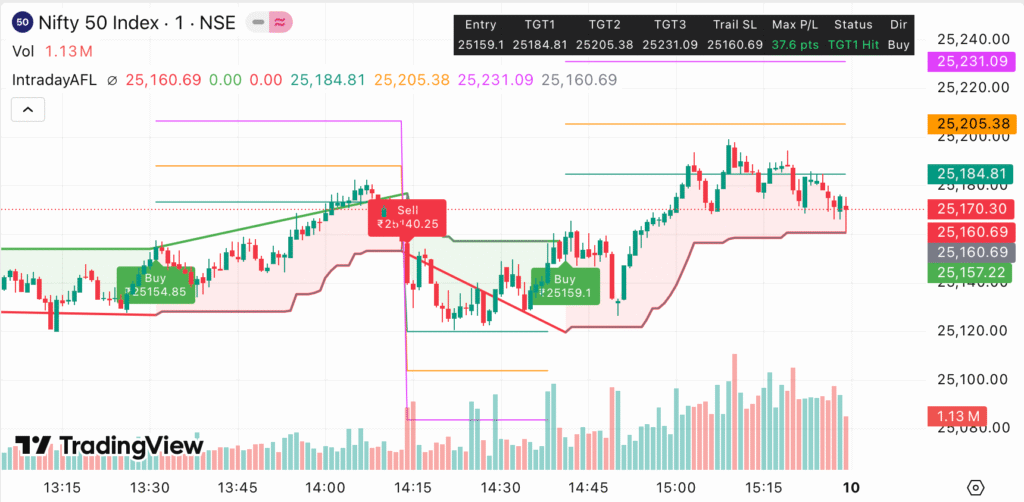

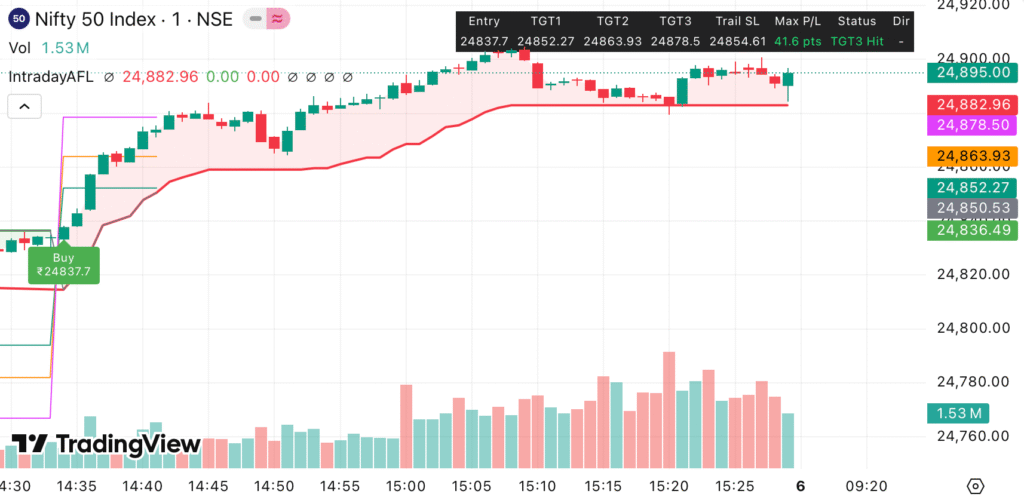

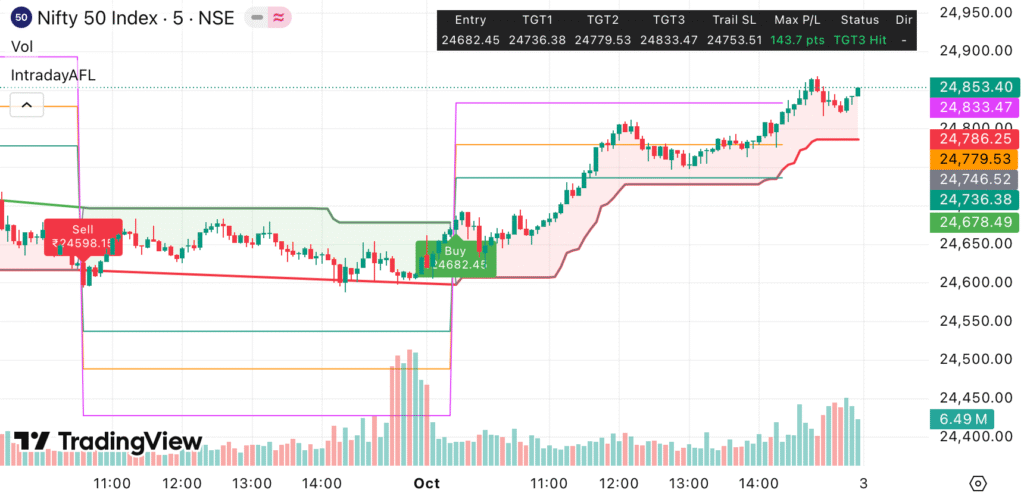

Nifty 50 Analysis

The Nifty 50 opened at 25,410.20 before witnessing early weakness. Subsequently, the index tested intraday highs around 25,448 levels. However, profit-booking pressure intensified during afternoon sessions. Consequently, the index closed near session lows at 25,327.05.

Technical analysis reveals the index trading within a critical range. Specifically, the 25,300-25,365 zone acts as a no-trading area. Furthermore, momentum indicators remain supportive despite today’s decline. Notably, the RSI sustains above 60 levels, indicating underlying strength.

Additionally, the index maintains its position above key moving averages. Particularly, the 20-day EMA at 25,200 provides immediate support. Similarly, the 50-day EMA around 25,100 offers secondary protection. Therefore, the overall trend structure remains intact.

Moreover, weekly charts display a cup-and-handle pattern formation. Subsequently, this technical setup suggests potential upside breakout opportunities. However, sustained volume confirmation remains essential for momentum continuation.

Link to our Free Buy-Sell Chart for real-time trading signals.

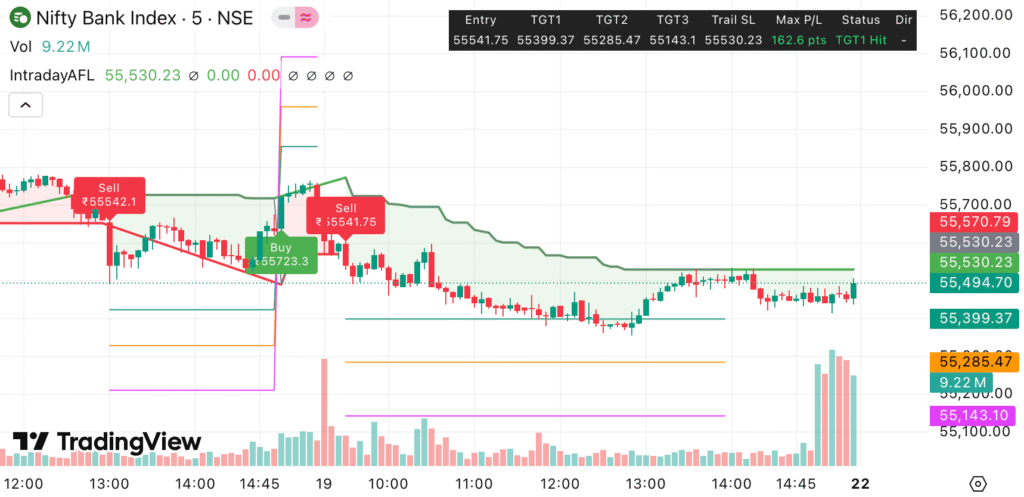

Bank Nifty Performance

Bank Nifty experienced more pronounced weakness, declining 268.60 points (-0.48%) to 55,458.85. Initially, the index opened at 55,647.95 before facing consistent selling pressure. Nevertheless, the banking sector had outperformed significantly during recent sessions.

The index’s 12-session winning streak concluded today. However, the correction appears healthy after substantial gains. Meanwhile, PSU banks provided relative strength with 1.28% gains. Conversely, private banking names witnessed profit-taking pressure.

Key technical levels show immediate support at 55,361 zone. Below this, the 55,032 and 54,780 levels become crucial. On the upside, resistance emerges at 55,832, followed by 56,000 psychological level.

Furthermore, banking sector fundamentals remain supportive. Particularly, expectations of monetary easing support sector outlook. Additionally, improving credit growth prospects provide long-term positive bias.

Global Market and Macro Updates

The Federal Reserve’s decision to cut rates by 25 basis points continues influencing global markets. Moreover, Fed Chair Jerome Powell indicated two additional cuts possible in 2025. Subsequently, this dovish stance supports emerging market assets including Indian equities.

However, US-India trade tensions persist despite resumed negotiations. Specifically, the US maintains 50% tariffs on Indian goods following Russian oil purchase concerns. Nevertheless, discussions showed positive progress according to official statements.

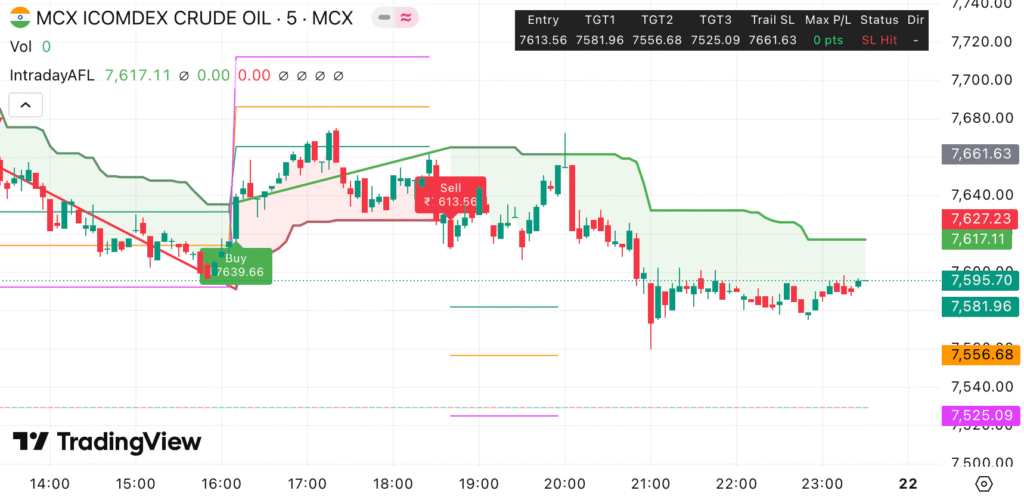

Additionally, global commodity markets reflect mixed sentiment. Notably, crude oil declined 1.11% amid demand concerns. Conversely, gold futures gained 0.32% on safe-haven buying. These developments impact India’s import bills and inflation outlook.

Furthermore, Asian markets displayed mixed performance during overnight sessions. Particularly, Japanese markets led gains following monetary policy decisions. Meanwhile, European indices showed cautious optimism ahead of central bank communications.

The ongoing China economic concerns continue weighing on regional sentiment. However, potential policy support measures could provide stability. Therefore, global macro environment remains fluid with multiple crosscurrents.

Technical Indicator Table

| Indicator | Nifty 50 | Bank Nifty | Interpretation |

|---|---|---|---|

| RSI (14) | 68.37 | 59.82 | Bullish momentum maintained |

| India VIX | 9.88 | – | Low volatility, stable market |

| PCR (Put-Call Ratio) | 0.82 | 0.75 | Bullish bias, call dominance |

| MACD | Bullish crossover | Neutral | Upward momentum intact |

| Volume (Mn) | 380.36 | 185.42 | Above average participation |

| Support Level 1 | 25,286 | 55,361 | Critical defense zones |

| Resistance Level 1 | 25,365 | 55,832 | Immediate breakout levels |

The technical setup reveals continued bullish undertones despite today’s correction. Moreover, momentum indicators support further upside potential. Additionally, low volatility environment favors trending moves.

Sector Performance Table

| Sector | Performance (%) | Key Drivers | Outlook |

|---|---|---|---|

| PSU Banks | +1.28% | Policy support expectations | Positive |

| Pharma | +0.50% | Regulatory clarity | Neutral |

| Realty | +0.42% | GST benefits anticipation | Positive |

| Metal | +0.25% | Global demand recovery | Neutral |

| Auto | -0.48% | Profit booking pressure | Cautious |

| FMCG | -0.52% | Rural demand concerns | Neutral |

| IT | -0.58% | Currency headwinds | Cautious |

| Private Banks | -0.65% | Valuation concerns | Neutral |

Sector rotation remains active with defensive names gaining preference. Meanwhile, growth sectors face temporary pressure from profit-taking activities. However, upcoming GST benefits should support consumption-linked sectors significantly.

Access advanced TradingView Indicators for detailed technical analysis.

Trading Strategy for September 22, 2025 (Intraday + Swing)

Intraday Trading Strategy

Nifty 50 Levels:

Targets: 25,442, 25,550, 25,647

Sell Below: 25,286 with volume confirmation

Downside Targets: 25,200, 25,148, 25,038

Bank Nifty Levels:

Targets: 55,995, 56,160, 56,490

Sell Below: 55,361 on sustained breakdown

Downside Targets: 55,032, 54,780, 54,396

Swing Trading Strategy

For swing positions, focus on the broader range dynamics. Specifically, Nifty’s support zone lies between 25,150-25,200. Meanwhile, resistance emerges around 25,500-25,600 levels. Therefore, position sizing should reflect these wider ranges.

Bank Nifty swing traders should monitor the 54,800-56,200 range. Additionally, sector-specific news flow could provide directional catalysts. However, overall banking sector fundamentals remain supportive for medium-term positions.

Furthermore, consider sector rotation opportunities. Particularly, PSU banks and consumption stocks could benefit from policy support. Conversely, maintain cautious stance on high-beta technology names amid global uncertainties.

Join our Hero Zero Option Calls for 2-5X profit potential per call.

Risk Management Guidelines

Maintain strict position sizing discipline during current market conditions. Specifically, limit individual position exposure to 2-3% of capital. Additionally, use trailing stops to protect profits during trending moves.

Moreover, monitor global cues closely for overnight developments. Particularly, watch US market performance and Asian opening levels. These factors significantly influence domestic market sentiment.

Furthermore, keep tracking institutional flow data for directional bias confirmation. Sustained FII buying could support higher levels. Conversely, continued selling pressure might limit upside potential.

Key Levels Table

| Index | Current Level | Support 1 | Support 2 | Resistance 1 | Resistance 2 |

|---|---|---|---|---|---|

| Nifty 50 | 25,327 | 25,286 | 25,200 | 25,365 | 25,442 |

| Bank Nifty | 55,459 | 55,361 | 55,032 | 55,832 | 56,160 |

| Sensex | 82,626 | 82,487 | 82,086 | 82,748 | 83,115 |

| Nifty Mid Cap | 59,094 | 58,800 | 58,500 | 59,400 | 59,800 |

| Nifty Small Cap | 19,446 | 19,200 | 19,000 | 19,600 | 19,800 |

These levels provide strategic reference points for both intraday and swing trading strategies. Moreover, volume confirmation at these levels enhances reliability significantly.

Final Thoughts

The Indian equity markets demonstrated resilience despite today’s profit-booking session. Furthermore, underlying fundamentals remain supportive with institutional backing continuing. Additionally, the upcoming GST rate cuts from September 22 could provide significant consumption boost.

However, global uncertainties require careful navigation. Specifically, US-India trade developments and Federal Reserve policy trajectory remain key variables. Nevertheless, domestic policy support and structural reform momentum provide medium-term confidence.

Technical setup suggests consolidation within defined ranges before next directional move. Meanwhile, sector rotation opportunities continue emerging across different themes. Therefore, selective stock picking becomes crucial for optimal returns.

Looking ahead, the festive season demand and policy support measures should drive market sentiment. Moreover, corporate earnings season approaches, providing fundamental catalysts. Hence, maintaining balanced exposure across sectors appears prudent.

Finally, risk management remains paramount given elevated global volatility. Specifically, position sizing and stop-loss discipline become essential. Additionally, staying informed about policy developments helps anticipate market moves effectively.

Disclaimer

This analysis is for educational and informational purposes only. It should not be considered as investment advice or a recommendation to buy or sell any securities. Trading in stock markets involves substantial risk of loss and is not suitable for all investors.

Past performance does not guarantee future results. All trading decisions should be made based on individual risk tolerance and financial objectives. Please consult with a qualified financial advisor before making any investment decisions.

The information provided is based on publicly available data and technical analysis. Market conditions can change rapidly, and all levels and strategies mentioned should be validated with current market data before implementation.

IntradayAFL.online and its associated entities are not responsible for any losses incurred from trading decisions based on this analysis. Always trade with proper risk management and never invest more than you can afford to lose.