Introduction

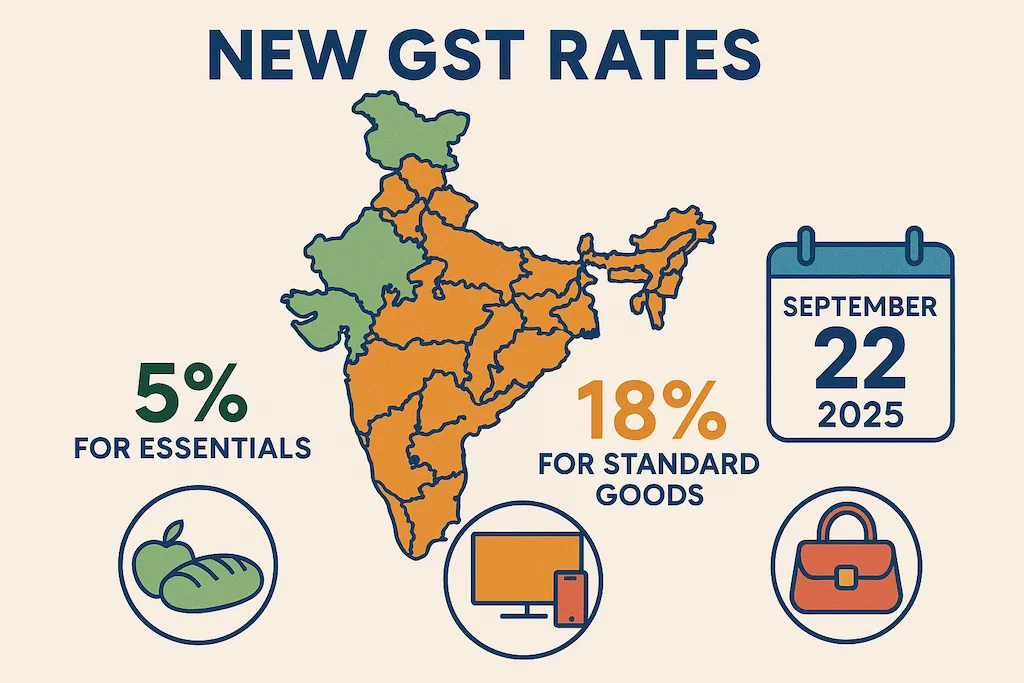

GST reforms in India will start on September 22, 2025. The government has introduced a new GST system. The goal is to make taxes simpler and lower costs for people and businesses. The move will affect prices, trade, jobs, and growth. Let’s see how the changes will shape the Indian economy.

What Has Changed in GST 2025?

The GST Council removed the confusing four-slab tax system. Now, most goods and services have two main GST rates: 5% and 18%. The highest 28% rate now covers very few luxury items. The old 12% slab disappears. Insurance premiums for health and life are GST-free now. These steps make the tax structure easy to understand.

| Item Type | Old Rate | GST 2.0 Rate |

|---|---|---|

| Essentials (like food, soap) | 12% or 18% | 5% |

| Consumer goods (electronics, services) | 18% | 18% |

| Luxury items (cars, tobacco) | 28% | 28% & 40%. Few items only. |

| Health/ Life Insurance Premium | 18% | 0% |

How Do These Reforms Affect Prices?

Prices of daily items will become cheaper. Essentials like shampoo, toothpaste, and food now get taxed at 5%. Many old 12% items move to the lower 5% rate. For electronic goods, the price drop will depend on input cost changes. Luxury cars and tobacco remain high, which helps control unhealthy consumption.

Consumers will save more money on the things they buy daily. Households should notice the difference in their grocery and utility bills.

Impact on Households and Shoppers

Indian households will benefit first. As taxes go down, products get cheaper. Cheaper goods mean families can buy more or save extra. Urban and rural areas both benefit. Middle-class families save lots on food, soaps, and kitchen items.

Dairy products see cuts as Amul and state cooperatives slash prices. Bottled water in trains now costs less. Experts expect total consumer savings to cross ₹2.5 lakh crore every year.

Business Benefits and MSMEs

Small businesses suffer less paperwork now. With only two main GST rates, accounting gets easier. MSMEs can focus on sales rather than confusing tax details. Lower taxes on raw materials help small factories and traders with costs.

The reforms also push the unorganized sector to join the formal system. More businesses will register for GST. This expands India’s taxpayer base and increases tax collection.

Manufacturing and trading will pick up as costs go down. Lower cement GST (now 18%) will push real estate projects and job creation. Textile GST falls to 5%. That makes local clothes cheaper and helps exports.

The Big Picture for India’s Economy

India’s GDP will get a push from higher consumer spending. With essentials taxed less, people spend more. Retail and FMCG companies will see faster volume growth.

Manufacturing grows as raw materials become cheaper. Auto companies gain by selling more cars and bikes. Two-wheelers and small cars are now within reach for more buyers.

Routine purchases and construction see better days. Job creation grows as working capital gets freed up. Exporters can offer more competitive prices.

Stock Markets and Investors Respond

Stock markets welcomed the reform news. FMCG and auto stocks rose, expecting higher sales. Cement, real estate, and textile stocks also climbed. Traders can now spot new market opportunities.

See key signals and trade plans on our Free Buy-Sell Chart. Use the TradingView Indicator to catch trends. Try Hero Zero Option Calls (2-5X Profit/Call) during policy-driven moves.

Revenue Collection and Fiscal Impact

Tax cuts mean the government collects a bit less for now. GST revenues may slip from ₹20.2 lakh crore to ₹19.7 lakh crore. The effective rate drops from 11.64% to 11.43%. Still, higher consumption and better compliance can offset the loss.

Monthly collections remain healthy, averaging ₹1.8 lakh crore. Experts expect GST revenue to bounce back as new taxpayers enter the system.

The government also removed the extra compensation cess on many items. Only tobacco and some luxury goods pay extra now.

Foreign Investment and Global Trust

Global investors view GST 2.0 as a step forward. It is simple and cost-effective. This makes India more attractive for multinationals. Sectors like health, energy, and infrastructure will see more foreign investments.

Predictable taxes help plan better and reduce risks. Many international firms are planning to expand in India.

Rollout Timeline and Transition

From September 22, 2025, most old rates will end. Tobacco and luxury items will keep their rates until the cess period completes. Companies will get clear instructions for invoicing and payments.

The new GST tribunal opens in September 2025. It will resolve business disputes faster. Refunds will be processed more quickly, reducing working capital issues.

Long-Term Structural Trends

GST 2.0 supports India’s goal of “One Nation, One Tax”. The reforms aim to make the tax system fairer and easier. Policymakers may soon move to a single standard GST rate. Over 70% of taxes come from the 18% slab, making further simplification possible.

This supports the government’s push for broader compliance and fairer taxes. It also prepares India for future growth and global competitiveness.

Actionable Advice for Traders and Businesses

Traders should track sector trends and adjust positions. Sectors like FMCG, auto, and textiles may see better gains. Businesses need to update their billing systems to match new rates.

Investors should monitor sector movements and use tools like TradingView and Buy-Sell Charts for timely decisions.

FAQs

| Question | Answer |

|---|---|

| Does GST 2025 cover all goods? | Almost all, except tobacco and some luxury items. |

| Will my daily expenses go down? | Yes, especially for food, toiletries, and dairy products. |

| Is it better for small businesses? | Yes. Less paperwork and lower costs help them grow. |

| Will GST rates stay stable? | Yes, the GST Council plans no major rate changes soon. |

Conclusion

GST reforms in 2025 mark a big step forward. The simple two-rate system benefits consumers, businesses, and the economy. Prices will fall, demand will rise, and compliance will improve. Markets and foreign investors expect positive moves. India gets closer to a fair, clear, and growth-friendly tax system.

Stay updated with the latest market insights at: