Nifty 50 & Bank Nifty Post-Market Analysis and Trading Strategy for 30th July 2025

Welcome to today’s post-market update by IntradayAFL. Below is a detailed breakdown of Nifty 50 and Bank Nifty performance on 29th July 2025, along with actionable intraday and swing trading strategies for tomorrow.

Key Takeaways

- Nifty 50 closed at 24,830.40, bouncing back after a sharp intraday dip to 24,625.

- Bank Nifty recovered from the 55,900 level to end at 56,230.15, showing resilience from PSU banks.

- Short covering led the last-hour rally in both indices.

- FII selling pressure is reducing, while DIIs are providing support.

- Global markets showing stable to positive cues ahead of major earnings releases.

Price Action Breakdown

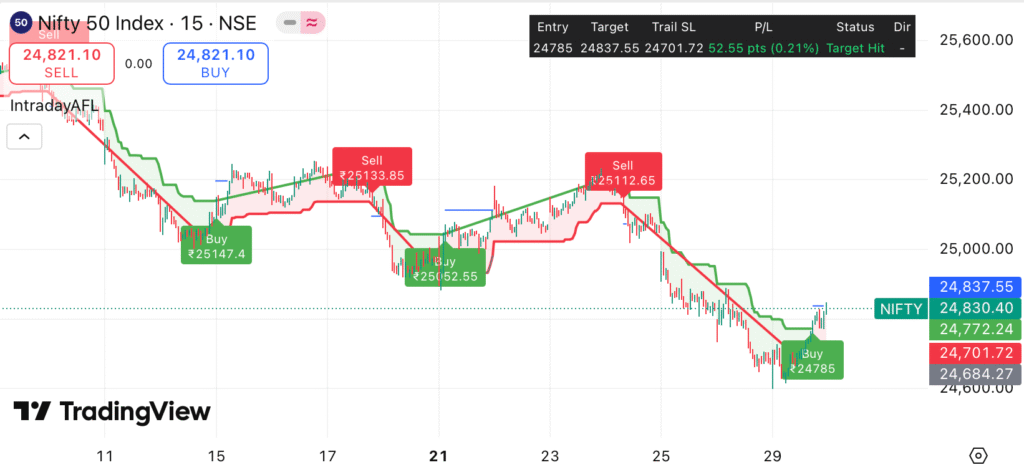

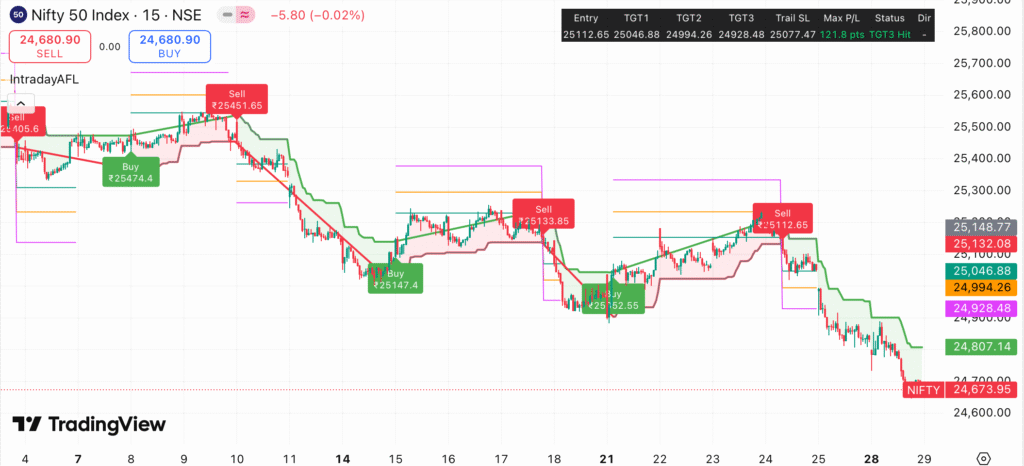

Nifty 50

Nifty opened on a flat note but faced early selling pressure that dragged it to an intraday low of 24,625. However, a sharp recovery followed, forming a V-shaped reversal on the 15-min chart. The index managed to reclaim 24,800, closing at 24,830.40. Buyers emerged strongly around the support zone of 24,600–24,650.

Bank Nifty

Bank Nifty displayed relative strength compared to Nifty, especially driven by buying in PSU and mid-tier private banks. After testing a key support level at 55,900, it bounced back sharply to close at 56,230.15. However, upside momentum remained capped due to weak sentiments in heavyweight private banks.

Global Market and Macro Updates

- US Futures indicate a marginally positive opening, with Dow Jones up by 0.2% and Nasdaq Futures gaining 0.3%.

- Crude Oil prices are trading stable at $82.30 per barrel, which is neutral for Indian equities.

- USDINR pair is stable near 83.22, indicating no immediate forex pressure.

- FIIs were net sellers of ₹850 crores, but DIIs bought ₹900 crores worth of equities, balancing the market flow.

Technical Indicator Table

| Indicator | Nifty 50 | Bank Nifty |

|---|---|---|

| RSI (14) | 44.5 (Neutral) | 41.8 (Neutral to Mildly Oversold) |

| India VIX | 12.78 (-1.2%) | — |

| Put Call Ratio (PCR) | 0.87 (Neutral) | 0.80 (Mildly Oversold) |

Sector Performance Table

| Sector | Performance | Outlook |

|---|---|---|

| Banking | +0.2% | Neutral |

| IT | +0.4% | Positive |

| FMCG | -0.1% | Weak |

| Pharma | +0.5% | Strong |

| Auto | +0.3% | Stable |

Trading Strategy for 30th July 2025 (Intraday + Swing)

Nifty Intraday Strategy

- Buy Above: 24,850

- Targets: 24,900 / 24,940

- Stop Loss: 24,800

Nifty Swing Strategy

- Swing Buy Above: 24,950

- Targets: 25,050 / 25,100

- Support Zone: 24,600–24,650

Bank Nifty Intraday Strategy

- Buy Above: 56,300

- Targets: 56,450 / 56,600

- Stop Loss: 56,150

Bank Nifty Swing Strategy

- Swing Buy Above: 56,600

- Targets: 56,900 / 57,200

- Support Zone: 55,900

Key Levels Table

| Index | Support 1 | Support 2 | Resistance 1 | Resistance 2 |

|---|---|---|---|---|

| Nifty 50 | 24,685 | 24,625 | 24,900 | 25,050 |

| Bank Nifty | 56,000 | 55,900 | 56,450 | 56,900 |

Final Thoughts

Markets have shown signs of reversal from key support zones. The recovery in Nifty and Bank Nifty suggests short-term bullish momentum could sustain if global cues remain favorable. Intraday traders should focus on quick breakouts above resistance levels, while swing traders can consider holding positions above breakout zones. Stay updated with real-time Buy-Sell Charts and leverage our TradingView Indicator for precision trading.

Disclaimer

This analysis is for educational purposes only. Trading in financial markets involves risks. Please consult your financial advisor before making any investment decisions. IntradayAFL does not guarantee returns or profits.