Nifty 50 & Bank Nifty Post-Market Analysis – 28 July 2025 | Trading Strategy for 29 July 2025

Key Takeaways

- Nifty 50 closed at 24,673.95, down by 0.02%.

- Bank Nifty ended at 56,053.30, slipping by 0.04%.

- Markets remained under pressure post a volatile week.

- Heavy sell-off seen in financials and IT sectors.

- Global cues remained mixed amid US Fed policy speculation.

Price Action Breakdown

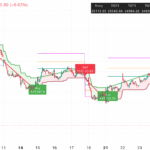

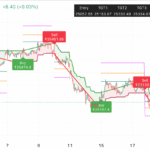

Nifty 50 (28 July 2025)

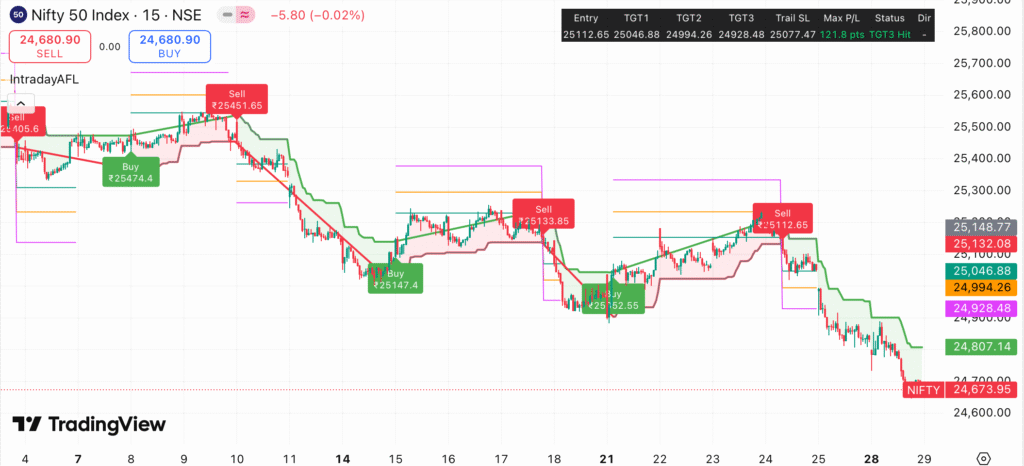

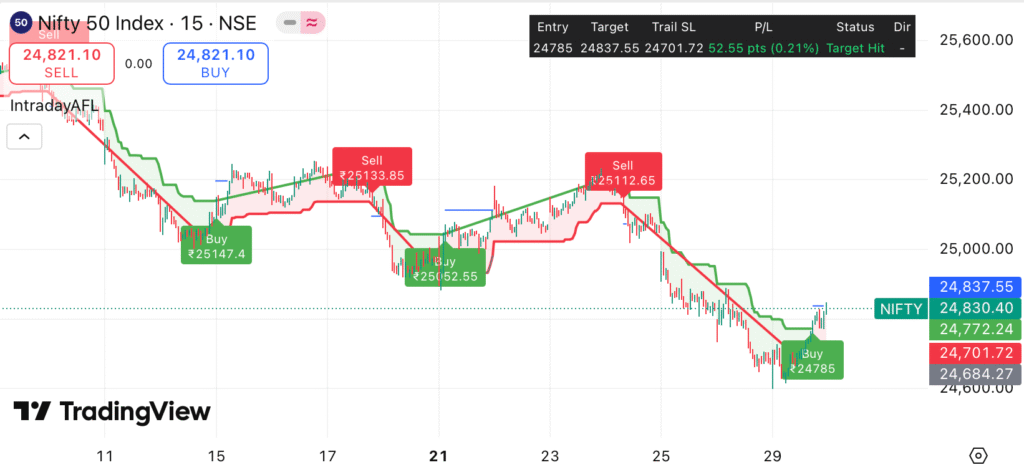

Nifty 50 witnessed a bearish continuation, breaking key support levels of 24,800. The index showed weakness after the sell signal at ₹25,112.65, as depicted in the TradingView Chart. All target levels up to TGT3 (₹24,928.48) were achieved swiftly, indicating strong bearish momentum.

The closing price of 24,673.95 suggests the index is now vulnerable towards the psychological level of 24,600.

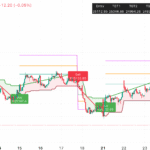

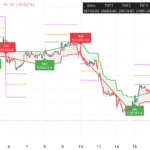

Bank Nifty (28 July 2025)

Bank Nifty mirrored Nifty’s bearish sentiment, closing at 56,053.30. The sell signal at ₹56,152.55 triggered a downward move, hitting TGT3 at ₹56,390.38. The intraday chart revealed consistent lower highs, pointing towards a dominant selling zone.

The critical support near ₹56,000 is now the last defense for bulls in the short-term.

Global Market and Macro Updates

- US Markets ended mixed as investors await key earnings and Fed’s policy stance. (Source: Reuters)

- Crude oil prices eased slightly after a sharp rally, providing minor relief to inflation concerns. (Source: Investing.com)

- Asian markets displayed cautious optimism; however, FIIs remained net sellers in Indian equities. (Source: Moneycontrol)

Technical Indicator Summary

| Indicator | Value | Bias |

|---|---|---|

| RSI (14) | 38.45 (Nifty) | Bearish |

| India VIX | 13.85 | Neutral |

| Put-Call Ratio (PCR) | 0.88 | Bearish |

Sector Performance (28 July 2025)

| Sector | Performance |

|---|---|

| Financials | -0.65% |

| IT | -0.48% |

| Pharma | +0.22% |

| Auto | Flat |

Trading Strategy for 29 July 2025 (Intraday + Swing)

Intraday Strategy

- Nifty 50: Watch for a retest of 24,700–24,750 zone. Below 24,650, expect a slide towards 24,500.

- For upside, a break above 24,800 could trigger short covering up to 24,900–24,950.

- Bank Nifty: A breach below 56,000 may extend the decline to 55,800.

- Upside reversal only above 56,400.

Swing Strategy

- Maintain a cautious bearish bias for Nifty until it sustains above 24,950.

- Bank Nifty swing traders should monitor 55,800 as a make-or-break level.

Key Levels to Watch (29 July 2025)

| Index | Support | Resistance |

|---|---|---|

| Nifty 50 | 24,600 | 24,950 |

| Bank Nifty | 56,000 | 56,400 |

For live Buy/Sell signals, visit our Free Buy-Sell Chart.

Final Thoughts

With weak global cues and sustained FII selling, Nifty and Bank Nifty are likely to remain under pressure in the near term. However, sharp pullbacks can’t be ruled out as markets are in oversold zones on lower timeframes. Traders are advised to maintain strict stop-losses and trade with light positions until clear directional moves emerge.

Disclaimer

The above analysis is for educational purposes only. Trading in financial markets involves risk. Please consult your financial advisor before making any trading decisions. We are not responsible for any losses incurred based on this analysis.