Nifty 50 & Bank Nifty Post-Market Analysis for 25 July 2025 & Trading Strategy for 28 July 2025

Key Takeaways

- Nifty 50 closed marginally lower at 24,832.20 (-0.05%).

- Bank Nifty underperformed, ending at 56,528.90 (-0.06%).

- Both indices show bearish bias with crucial supports tested.

- Intraday sellers dominated the session; swing traders should stay cautious.

Price Action Breakdown

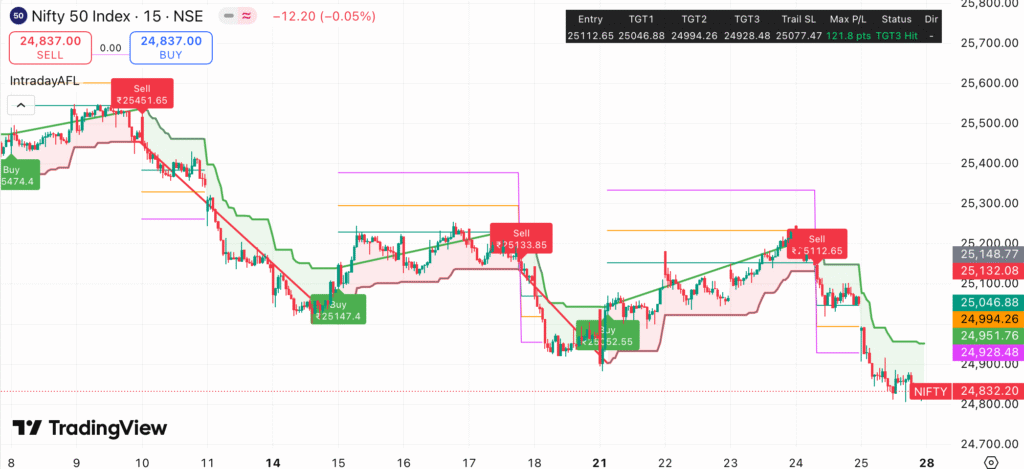

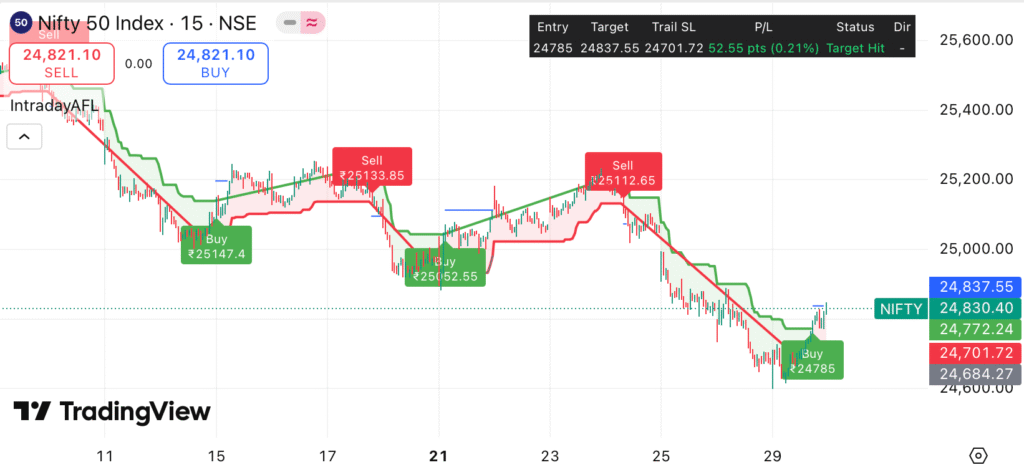

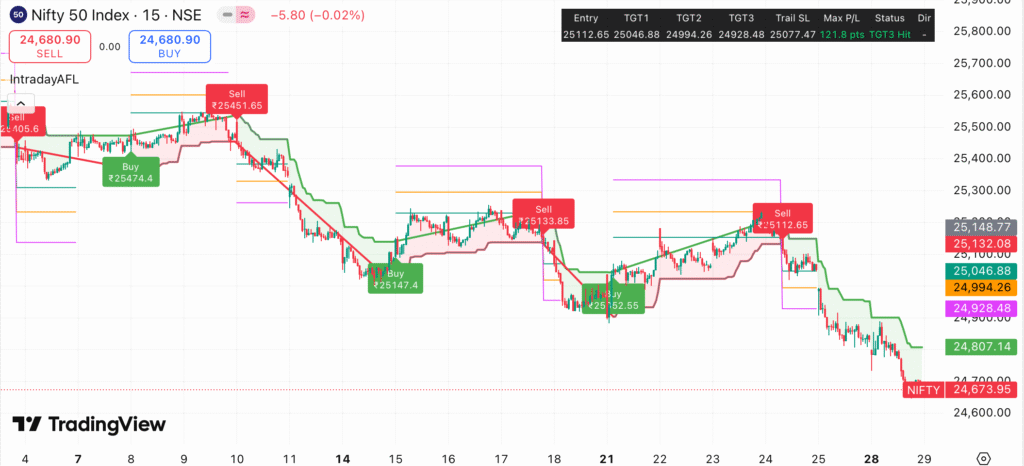

Nifty 50

Nifty 50 traded in a narrow range but maintained a bearish undertone throughout the session. After an opening near 25,100 levels, the index faced selling pressure, breaching key supports at 25,046.88 and 24,994.26, eventually closing near the day’s low of 24,832.20. The sell trigger at ₹25,112.65 indicated clear bearish dominance as sellers defended every minor pullback.

Bank Nifty

Bank Nifty mirrored Nifty’s weakness but displayed more pronounced volatility. The index failed to sustain above 57,000 psychological mark, triggering a sell-off from ₹56,952.55 down to 56,528.90. Intraday scalpers captured short trades successfully, while swing setups remain under pressure unless 56,733.55 resistance is crossed decisively.

Global Market and Macro Updates

- US markets closed mixed; Dow Jones was flat while Nasdaq dipped mildly (Source: Reuters).

- Asian markets showed subdued sentiment with Hang Seng leading losses (Source: FXStreet).

- Brent Crude hovered near $83/bbl impacting inflationary concerns.

- FII/DII flows remained neutral, but volumes were thin.

Technical Indicator Table

| Index | RSI (14) | India VIX | Put-Call Ratio (PCR) |

|---|---|---|---|

| Nifty 50 | 42.85 (Bearish) | 11.72 (+2.1%) | 0.88 |

| Bank Nifty | 40.12 (Bearish) | — | 0.82 |

Sector Performance

| Sector | Performance | Trend |

|---|---|---|

| IT | -0.45% | Weak |

| Banking | -0.52% | Bearish |

| Auto | +0.25% | Outperformer |

| FMCG | -0.10% | Neutral |

Trading Strategy for 28/7/25 (Intraday + Swing)

Intraday Strategy

- Nifty 50: Sell on rise towards 24,950–24,980 with SL at 25,046.88. Targets: 24,800 / 24,750.

- Bank Nifty: Focus on short trades below 56,733.55 with SL at 56,820.90. Targets: 56,400 / 56,250.

Swing Strategy

- Swing traders should maintain light positions with tight stop-losses.

- Nifty needs a closing above 25,112 for bullish reversal; till then, selling on rallies remains safer.

- Bank Nifty swing resistance stands at 57,000–57,100; selling pressure likely if this zone holds.

Key Levels Table

| Index | Support 1 | Support 2 | Resistance 1 | Resistance 2 |

|---|---|---|---|---|

| Nifty 50 | 24,800 | 24,750 | 24,950 | 25,112 |

| Bank Nifty | 56,400 | 56,250 | 56,733 | 57,000 |

Final Thoughts

Both Nifty 50 and Bank Nifty are trading near critical support zones with a bearish tilt. Until key resistances are reclaimed, short trades will dominate. Intraday scalping opportunities are abundant with volatility spikes. Swing traders should wait for a breakout confirmation above immediate resistances.

Stay updated with Free Live Buy-Sell Chart and explore our TradingView Indicator for real-time setups.

Disclaimer

The above analysis is for educational purposes only. Trading in financial markets involves risks. Please consult with your financial advisor before making any trading decisions.