Nifty 50 & Bank Nifty Post-Market Analysis (23/07/25) & Trading Strategy for 24/07/25

Key Takeaways

- Bank Nifty surged 267 points, closing near 57,210 with bullish momentum.

- Nifty 50 remained steady, holding support near 25,100 and resisting at 25,250.

- Intraday reversal in Bank Nifty confirmed by breakout above 56,900.

- Global cues remained mixed; US futures flat, Asian markets in green.

Price Action Breakdown

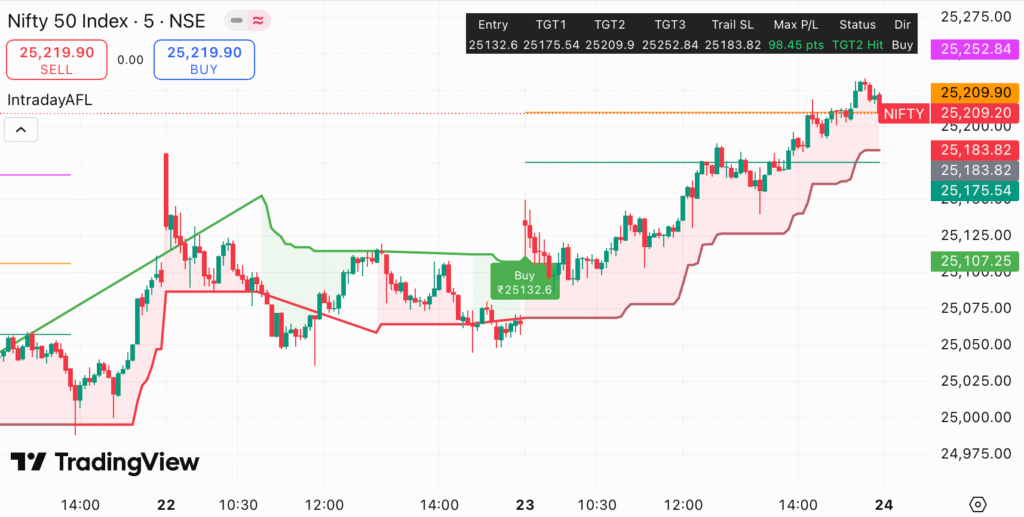

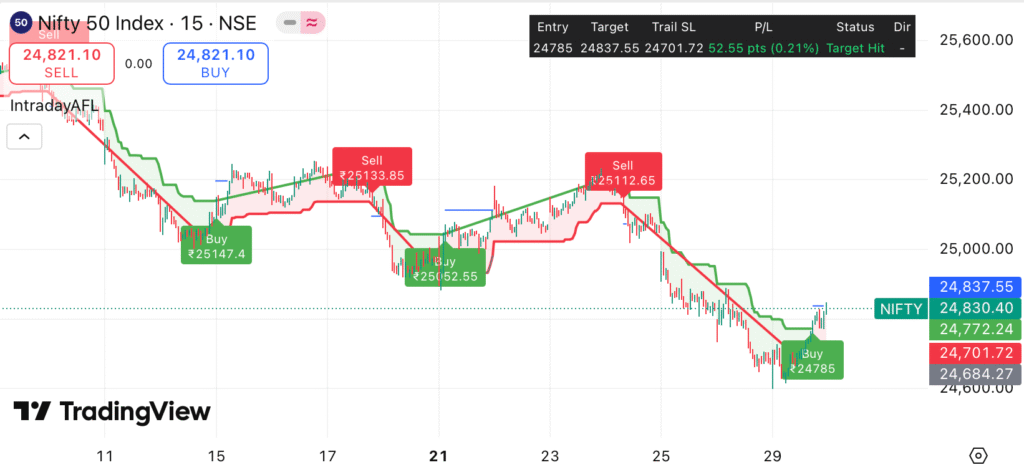

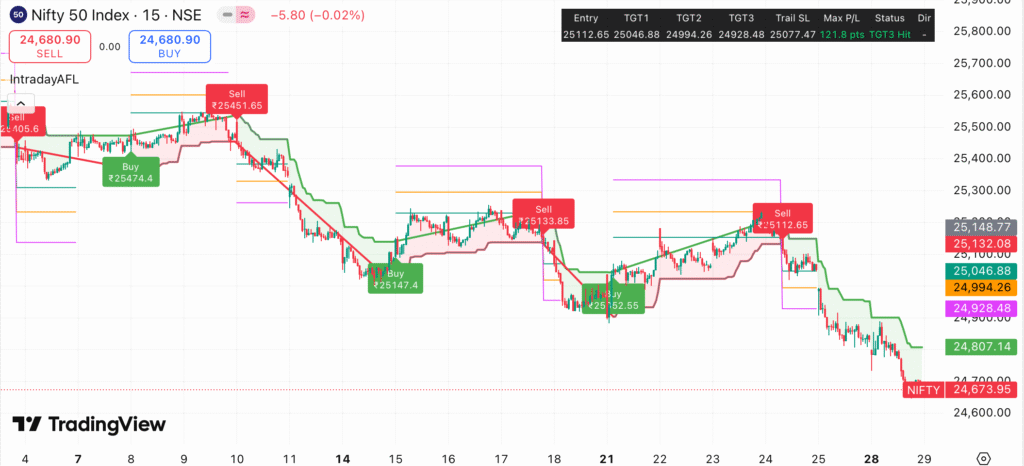

Nifty 50

Nifty 50 traded within a narrow range of 25,100 to 25,250 throughout the session. Early selling pressure pushed the index towards 25,060, but bulls defended the zone strongly. A decisive move above 25,132.6 triggered intraday buy signals, with targets of 25,175.54 and 25,209.90 being achieved. The immediate resistance at 25,252.84 is critical for a breakout towards 25,300 in the next session.

Bank Nifty

Bank Nifty started weak, slipping towards 56,800. However, a strong demand zone triggered a bullish reversal. The breakout above 56,900 activated long trades, hitting all three targets (TGT1-56,988.20, TGT2-57,066.20, TGT3-57,163.70) with a maximum P/L of 267 points, as seen in the Free Buy-Sell Chart.

Global Market and Macro Updates

- US Markets: Dow Jones and S&P 500 closed flat; Nasdaq showed minor gains. (Source: Reuters)

- Asian Markets: Nikkei and Hang Seng ended higher, indicating positive sentiment.

- Crude Oil traded near $82/barrel, supporting Indian Oil PSUs. (Source: Investing.com)

- INR remained stable at 83.10 against USD.

Technical Indicator Table

| Index | RSI (14) | India VIX | Put-Call Ratio (PCR) |

|---|---|---|---|

| Nifty 50 | 54.30 (Neutral) | 12.85 (Stable) | 1.04 (Mild Bullish) |

| Bank Nifty | 58.70 (Bullish) | — | 0.98 (Neutral) |

Sector Performance Table

| Sector | Performance |

|---|---|

| IT | +0.65% |

| FMCG | +0.50% |

| Banking | +0.42% |

| Auto | -0.20% |

| Pharma | Flat |

Trading Strategy for 24/07/25 (Intraday + Swing)

Intraday Strategy

- Bank Nifty: Look for bullish continuation above 57,250 for targets of 57,400-57,500. Stop-loss at 57,100.

- Nifty 50: Buy above 25,220 for targets of 25,250-25,300. Stop-loss at 25,175.

- Sideways to bullish bias if global cues remain stable.

Swing Strategy

- Bank Nifty has formed a bullish flag breakout on the 5-minute chart (as per TradingView Indicator), maintain long positions with trailing SL below 56,900.

- Nifty 50 swing traders should hold long if 25,100 support sustains, with targets of 25,300-25,400 over the next few sessions.

Key Levels Table

| Index | Support | Resistance |

|---|---|---|

| Nifty 50 | 25,100 | 25,250 / 25,300 |

| Bank Nifty | 57,000 | 57,400 / 57,500 |

Final Thoughts

Nifty 50 is consolidating in a tight band but a breakout above 25,252 will trigger fresh buying momentum. Bank Nifty remains bullish above 57,000 and is poised for further upside. Watch global cues and institutional flows for intraday moves. IT and FMCG sectors continue to provide a cushion to the indices.

Disclaimer

This analysis is for educational purposes only. Please consult your financial advisor before making any trading decisions. The website IntradayAFL is not responsible for any financial losses.