Nifty & Bank Nifty Analysis for 22 July 2025 | Intraday & Swing Strategy for 23 July

Welcome to your trusted market analysis portal, IntradayAFL. In this post, we break down the latest price action of the Nifty 50 and Bank Nifty indices, technical indicators, global factors, and provide a detailed strategy for 23 July 2025.

Key Takeaways

- Nifty 50 closed flat at 25,064.90 with intraday volatility.

- Bank Nifty ended marginally lower at 56,756.00.

- Technical indicators point toward consolidation with slight bullish bias for Nifty.

- Bank Nifty shows weakness below 56,700; cautious approach recommended.

Price Action Breakdown

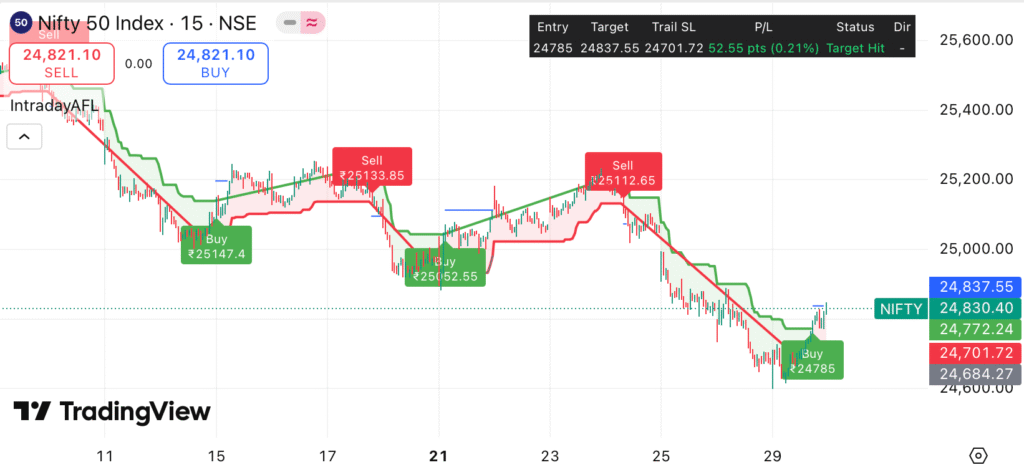

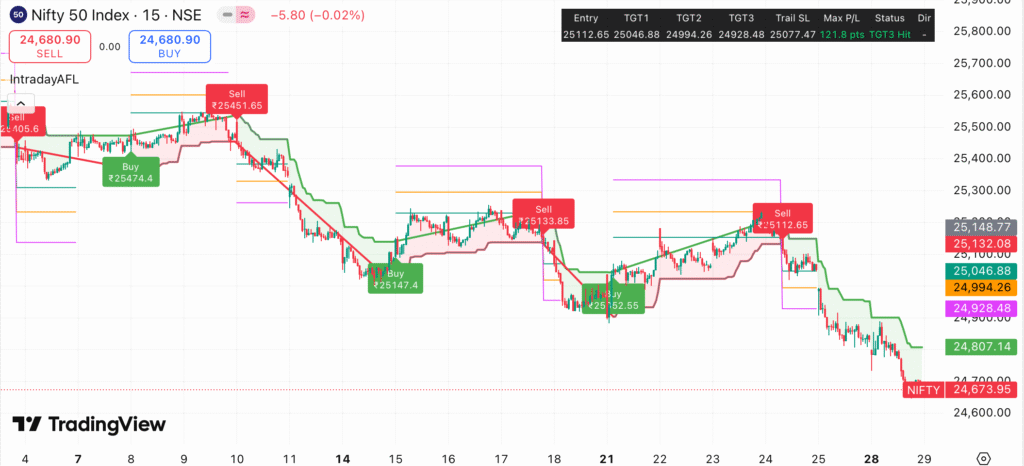

Nifty 50

Nifty opened slightly higher and faced resistance near the 25,153 zone. After testing support around 25,022.72, it rebounded to close at 25,064.90. Several buy and sell signals were triggered during the day, with a notable buy at ₹25,052.55 hitting TGT1. The market lacked strong directional momentum, suggesting indecisiveness among traders.

Bank Nifty

Bank Nifty struggled to hold gains and showed weakness near the 56,721.75 level. A sell call was active at this price with no major profits booked yet. The index is trading near support, and a breakdown below 56,700 could trigger further downside. A previous buy at ₹56,579.4 showed potential, but follow-through was weak.

Global Market and Macro Updates

- US markets closed mixed as investors await Fed commentary (Reuters).

- Crude oil prices remain steady; Brent near $83/barrel (Investing.com).

- USDINR is range-bound around 83.30, reflecting stable forex sentiment.

- FII activity turned marginally positive after a week of selling pressure (Moneycontrol).

Technical Indicator Table

| Indicator | Nifty 50 | Bank Nifty |

|---|---|---|

| RSI (14) | 49.2 (Neutral) | 46.8 (Mild Bearish) |

| India VIX | 12.04 | 12.04 |

| Put Call Ratio (PCR) | 1.05 (Balanced) | 0.91 (Bearish) |

Sector Performance Table

| Sector | Change (%) | Trend |

|---|---|---|

| IT | +0.85% | Bullish |

| Banking | -0.22% | Bearish |

| Auto | +0.44% | Mild Bullish |

| FMCG | -0.15% | Flat |

| Pharma | +0.12% | Sideways |

Trading Strategy for 23/07/25 (Intraday + Swing)

Nifty 50

- Intraday: Look for buying opportunities above 25,100 with targets at 25,153 and 25,233.

- Sell below: 25,022 for downside targets of 24,950 and 24,880.

- Swing: Stay long above 25,153 on closing basis for next leg towards 25,334.

Bank Nifty

- Intraday: Sell below 56,700 for targets of 56,513 and 56,346.

- Buy only above: 56,900 for short covering towards 57,038.

- Swing: Hold shorts below 56,721 with trail stop-loss at 57,038.

Key Levels Table

| Index | Support | Resistance | Breakout Buy | Breakdown Sell |

|---|---|---|---|---|

| Nifty 50 | 25,022 | 25,153 / 25,233 | 25,153 | 25,022 |

| Bank Nifty | 56,513 | 57,038 | 56,900 | 56,700 |

Final Thoughts

The market is showing signs of hesitation as we approach key resistance levels. Traders should be nimble and respect stop-loss levels. For precise, real-time trade setups, refer to our Free Buy-Sell Chart and access the premium TradingView Indicator.

Disclaimer

This article is for educational and informational purposes only. Trading in financial markets involves risk. Please consult your financial advisor before making any investment decisions. Past performance is not indicative of future results.