Nifty & Bank Nifty Post-Market Analysis – 21 July 2025 | Strategy for 22 July

Key Takeaways

- Nifty closed flat with mild gains at 25,093.30 (+0.02%).

- Bank Nifty ended marginally lower at 56,916.75 (-0.07%).

- Strong recovery seen from morning lows in both indices.

- Technical buy signal activated on both Nifty and Bank Nifty by close.

- Intraday support respected, with short-covering visible in late trade.

Price Action Breakdown

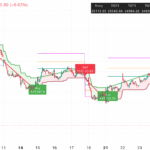

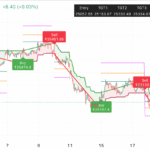

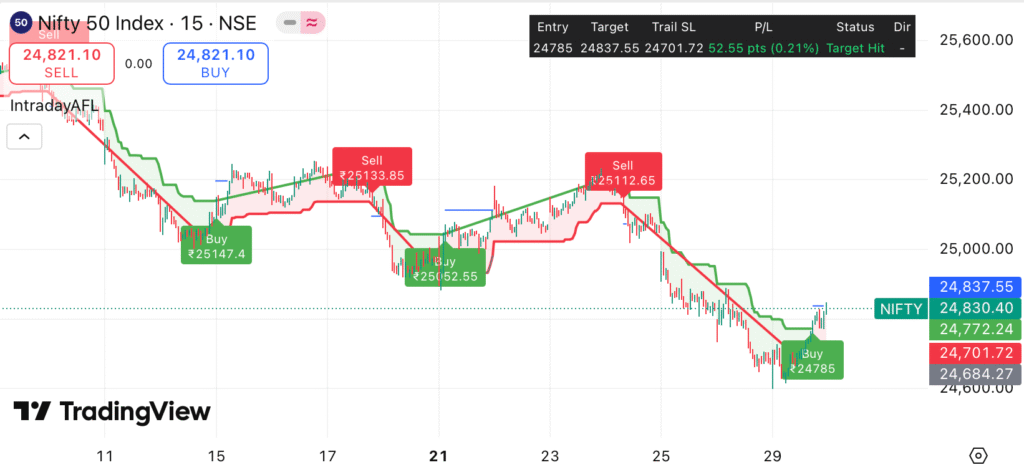

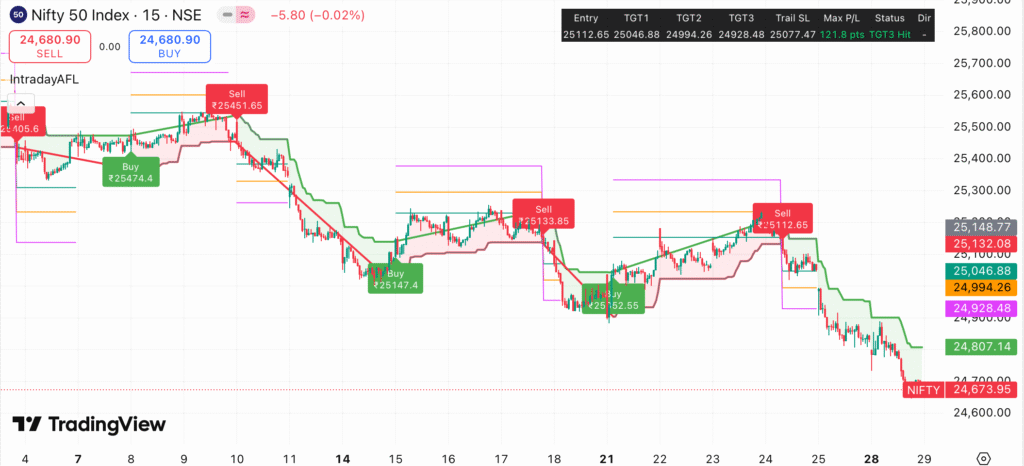

Nifty 50

Nifty opened on a weak note but found support at 24,962.55, as indicated by the green buy signal. From there, it gradually climbed, closing near the high at 25,093.30. A bullish structure is forming with key intraday resistance around 25,153.07. A breakout above 25,153.07 could trigger further upside.

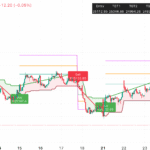

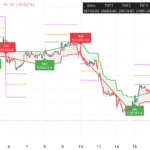

Bank Nifty

Bank Nifty mirrored Nifty’s recovery. After a sharp morning drop to 56,579.40, it staged a V-shaped recovery, closing near the day’s high at 56,916.75. A fresh buy signal was generated with an entry of 56,679.40, which hit TGT1 at 56,959.02 successfully. Momentum may pick up if it crosses 57,182.72.

Global Market and Macro Updates

- US markets ended mixed on Friday amid rising bond yields. [Reuters]

- Asian peers opened cautiously ahead of key central bank announcements. [FXStreet]

- Crude oil prices remained steady, with Brent near $83/barrel. [Moneycontrol]

- INR stable near 83.04/USD, FII flows remain neutral. [Investing.com]

Technical Indicator Table

| Indicator | Nifty | Bank Nifty |

|---|---|---|

| RSI (14) | 52.6 (Neutral) | 54.1 (Neutral) |

| India VIX | 12.18 (Low Volatility) | |

| Put-Call Ratio (PCR) | 0.96 (Neutral Bias) | |

Sector Performance Table

| Sector | Performance |

|---|---|

| Auto | +0.85% |

| Banking | -0.12% |

| IT | +0.45% |

| Pharma | +0.33% |

Trading Strategy for 22/07/2025 (Intraday + Swing)

Nifty 50

- Intraday: Watch for breakout above 25,153.07. Targets: 25,233.49 / 25,334.02. Trail SL: 24,981.40.

- Swing: As long as 25,042.87 holds, maintain bullish bias. Close below this may invite selling.

Bank Nifty

- Intraday: If price sustains above 56,959.02, expect TGT2 at 57,182.72. Keep SL below 56,608.47.

- Swing: Hold long if 56,567.20 is respected. Move above 57,182.72 could trigger momentum up to 57,462.34.

Use our Free Buy-Sell Chart to track live signals, or explore our TradingView Indicator for automation.

Key Levels Table

| Index | Support | Resistance | Buy Entry | Targets |

|---|---|---|---|---|

| Nifty | 25,042.87 | 25,153.07 | 25,052.55 | 25,153 / 25,233 / 25,334 |

| Bank Nifty | 56,608.47 | 56,959.02 | 56,679.40 | 56,959 / 57,182 / 57,462 |

Final Thoughts

Market recovery toward the close suggests renewed buying interest. A gap-up open above resistance could attract further momentum trades. However, global cues and FII behavior will remain critical. Intraday traders should stay nimble and follow key levels closely with disciplined stop-loss management.

Disclaimer

This analysis is for educational purposes only. Trading in the stock market involves financial risk. Please consult with a registered financial advisor before taking any positions.