Nifty & Bank Nifty Post-Market Analysis for 10 July 2025 + Strategy for 11 July

Markets remained volatile on 10 July 2025 with sharp reversals and range-bound moves. Let’s break down the key price action, sector strength, global cues, and provide a tactical strategy for 11 July 2025 for both intraday and swing traders.

📌 Key Takeaways

- Nifty closed at 25,348.25, down marginally with strong resistance near 25,450.

- Bank Nifty ended at 56,956.95 after facing heavy resistance at 57,200–57,300.

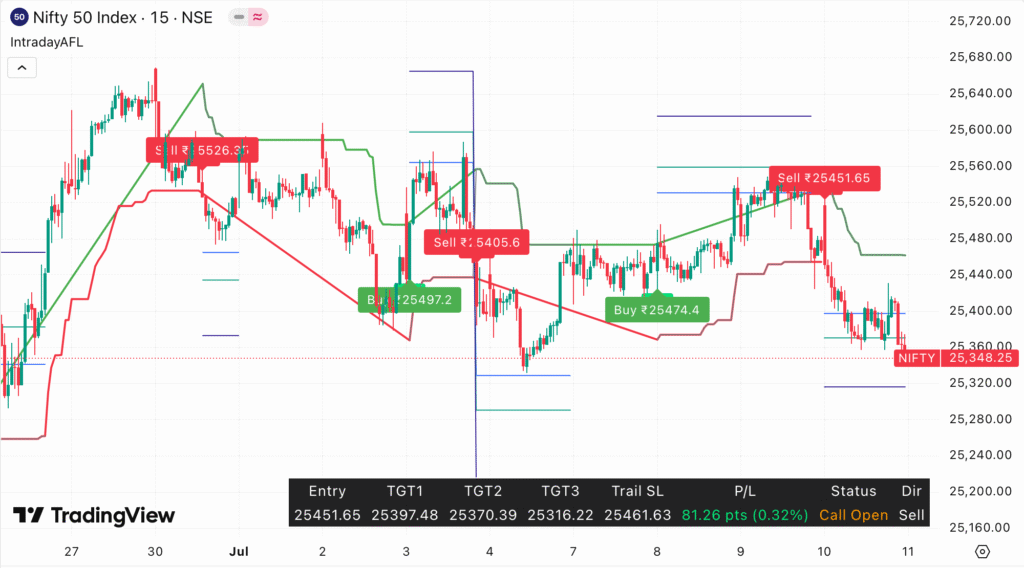

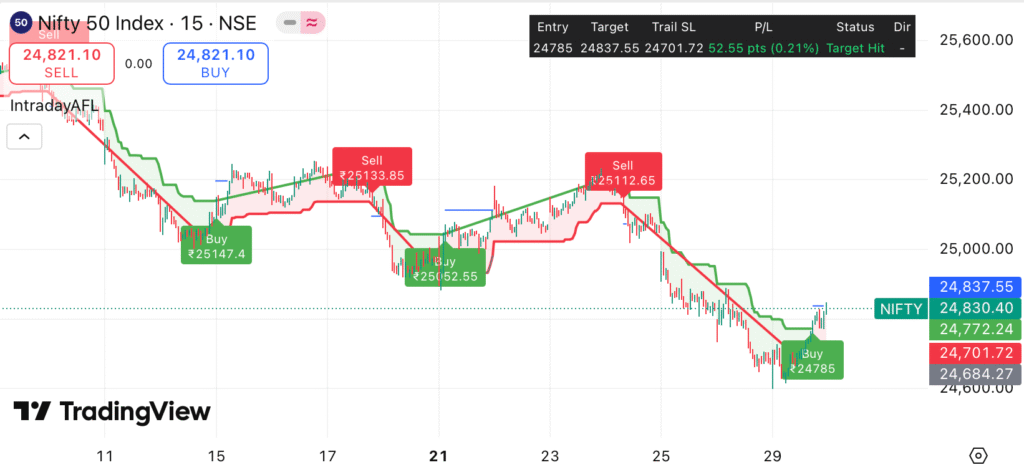

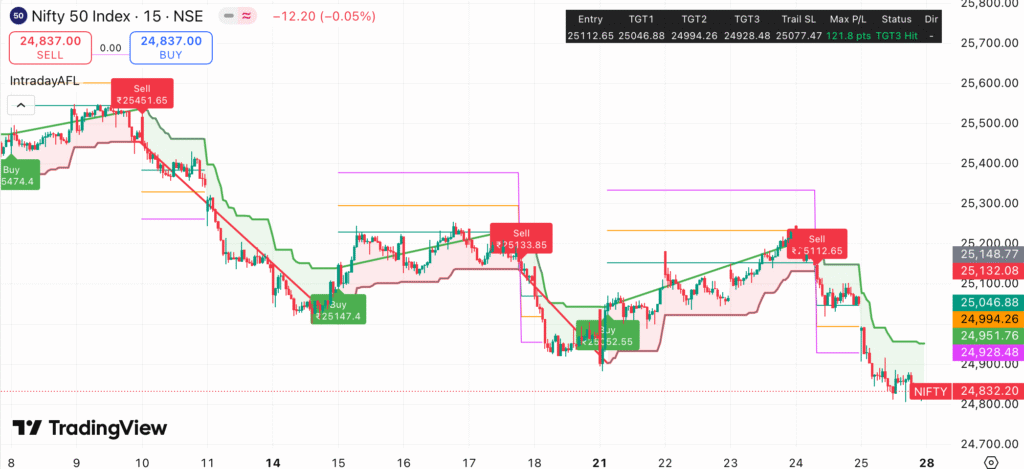

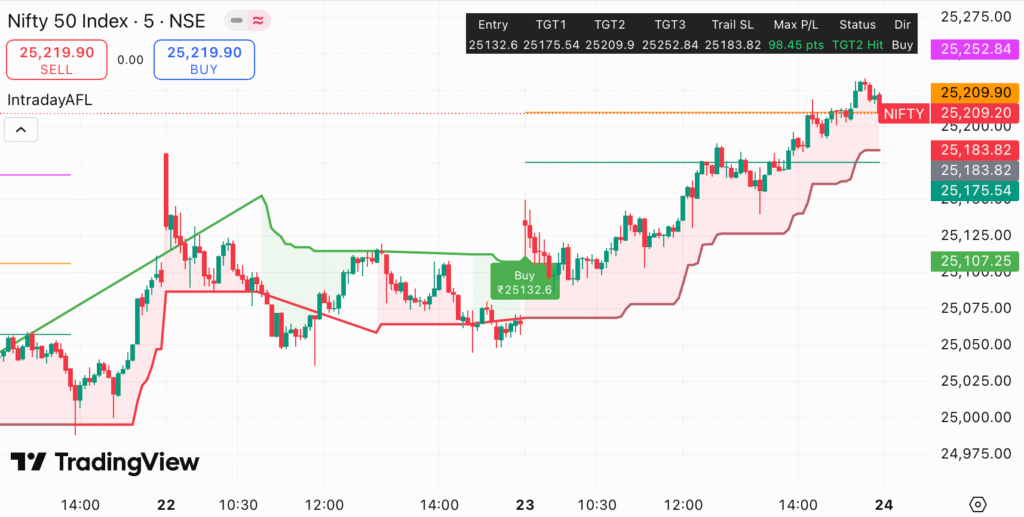

- Multiple intraday sell signals were triggered based on the IntradayAFL TradingView Indicator.

- Volatility in the second half provided shorting opportunities on both indices.

📊 Price Action Breakdown

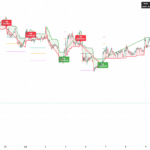

Nifty 50

Nifty opened flat and traded with mild bullish bias initially. The index gave a Sell signal at ₹25,451.65 and hit TGT1 and TGT2 before consolidating. Support was seen near ₹25,316 but selling resumed with weakness into the close. Resistance remains at ₹25,500 while downside remains open till ₹25,280.

Bank Nifty

Bank Nifty attempted to rally early but failed to sustain above ₹57,300. A Sell was triggered at ₹57,025.85 and the index drifted lower steadily, closing near day’s low at ₹56,956.95. The structure is weak below ₹57,100 and could test ₹56,700 if selling continues.

🌐 Global Market & Macro Updates

- US markets traded range-bound as investors await CPI inflation data due Thursday. [Reuters]

- Brent Crude cooled off to $84/bbl, easing inflation concerns. [Investing.com]

- Dollar Index remained flat near 104.9 while Indian Rupee closed steady at 83.40/USD. [FXStreet]

📈 Technical Indicator Table

| Indicator | Nifty | Bank Nifty |

|---|---|---|

| RSI (14) | 41 (Bearish) | 43 (Bearish) |

| India VIX | 13.45 (Mild volatility) | |

| Put-Call Ratio (PCR) | 0.87 (Bearish) | 0.91 (Neutral-Bearish) |

🏦 Sector Performance

| Sector | Performance | Trend |

|---|---|---|

| IT | -0.45% | Weak |

| Banking | -0.65% | Bearish |

| Auto | +0.35% | Positive |

| FMCG | +0.12% | Stable |

| Metal | -1.10% | Weak |

📌 Trading Strategy for 11 July 2025

Intraday Strategy

- 📉 Nifty: Sell on rise near ₹25,420–25,460 with SL ₹25,500. Targets ₹25,280 / ₹25,200.

- 📉 Bank Nifty: Sell below ₹57,000 with SL ₹57,300. Targets ₹56,800 / ₹56,650.

Swing Strategy

- 🔁 Nifty: Trend reversal only above ₹25,600. Until then, use rallies to exit longs.

- 🔁 Bank Nifty: Structure remains bearish. Watch for breakdown below ₹56,800 for fresh swing shorts.

Track live trades on our Free Buy-Sell Signal Chart.

📊 Key Levels for 11 July 2025

| Index | Support | Resistance | Trend |

|---|---|---|---|

| Nifty | 25,280 / 25,200 | 25,460 / 25,520 | Bearish |

| Bank Nifty | 56,800 / 56,650 | 57,300 / 57,500 | Bearish |

🔚 Final Thoughts

Markets remain sensitive to global cues and earnings season developments. Use trailing stops and trade light during volatility spikes. Momentum remains with the bears unless key resistances are crossed.

📢 Disclaimer

This analysis is for educational purposes only. Always consult your financial advisor before making trading decisions. Trading involves substantial risk of loss.