Analyze how Nifty 50 and Bank Nifty performed on July 7, 2025, and explore actionable trading strategies for July 8. We use our proprietary Free Buy-Sell Signal Chart and the powerful TradingView Indicator to decode the price action.

🔍 Key Takeaways

- Nifty closed nearly flat at 25,454.95, down by 8.05 points (-0.03%).

- Bank Nifty also remained muted, closing at 57,024.82, down 34.95 points (-0.06%).

- Volatility stayed low, favoring range-bound trades with narrow risk-reward setups.

- IntradayAFL signals captured precise entry/exit zones with target hits on both indices.

📊 Price Action Breakdown

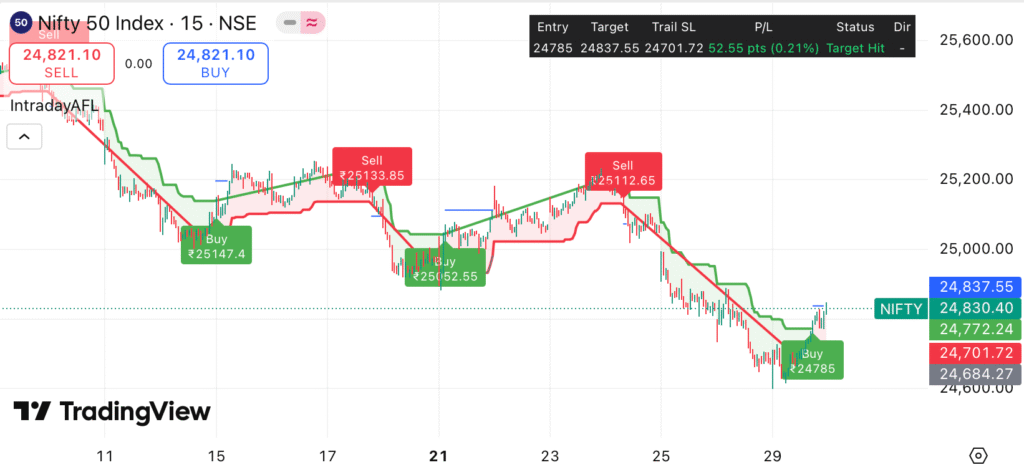

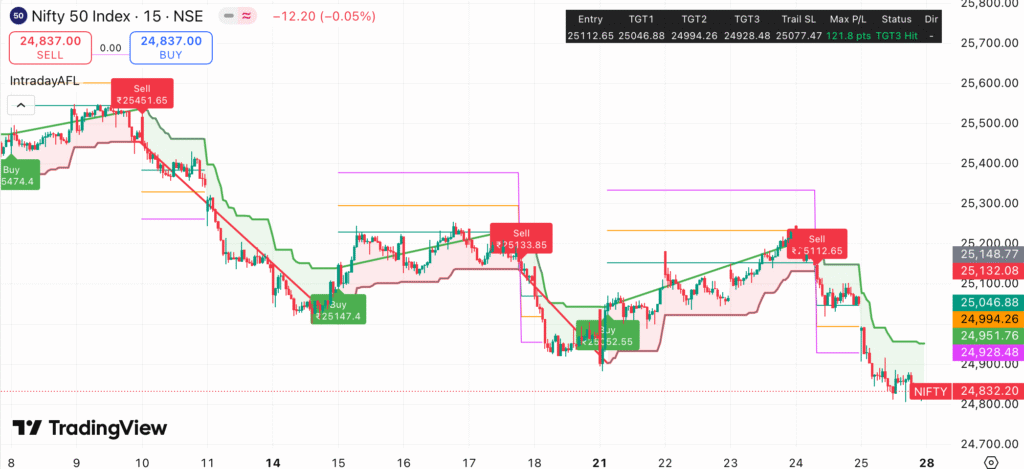

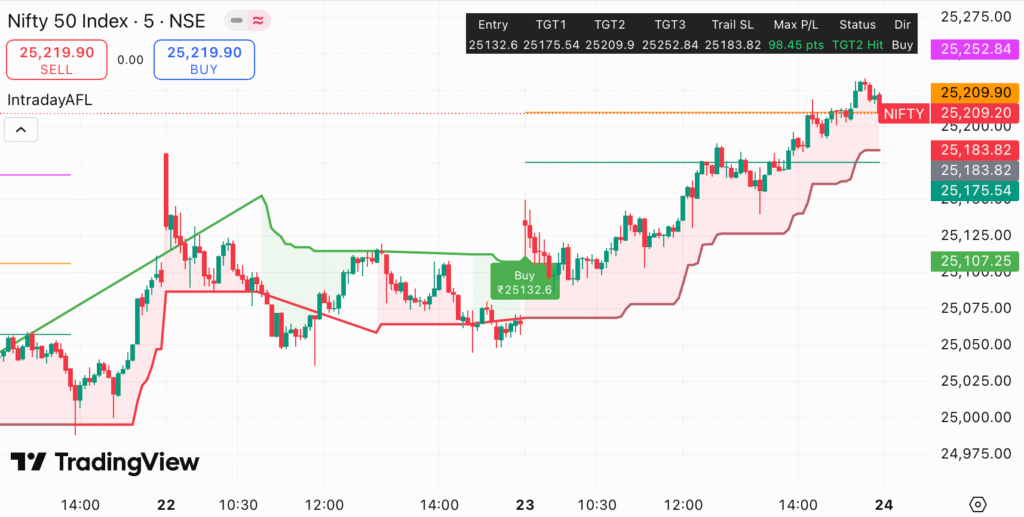

Nifty 50

Nifty opened with a minor gap-up and gave a brief upward spike but failed to sustain above 25,500. After a sell signal at ₹25,499.45, the index drifted downward. A buy signal was generated at ₹25,433.45 on July 7, which successfully hit the target at ₹25,456.68 with a trail SL at ₹25,395.71, ending with a modest gain of 23.23 points.

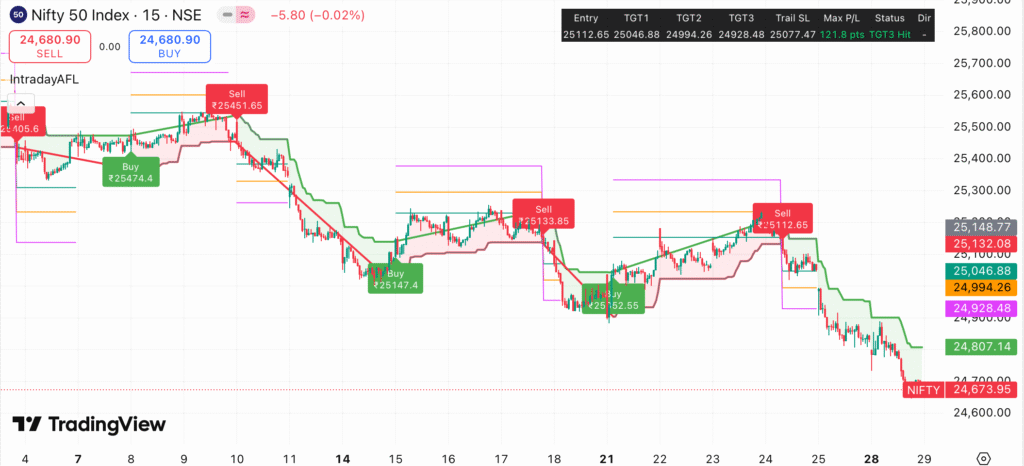

Bank Nifty

Bank Nifty remained weak post opening and experienced selling pressure throughout July 2 to July 4. A strong reversal came on July 4 with a buy signal at ₹56,870.45, followed by a target hit at ₹56,787.22. The system locked in 24.66 points profit, showcasing the power of disciplined execution in sideways markets.

🌍 Global Market and Macro Updates

- U.S. markets were mixed overnight; the Nasdaq remained strong, while Dow slipped marginally. (Source: Reuters)

- Crude oil prices remained firm above $84/barrel due to Middle East tensions.

- India’s 10-year bond yield remained stable near 7.05%.

- Rupee traded flat at 83.32/USD, with marginal dollar inflows supporting the currency. (Source: Moneycontrol)

📈 Technical Indicator Summary

| Indicator | Nifty | Bank Nifty |

|---|---|---|

| RSI (14) | 54 (Neutral) | 47 (Mildly Bearish) |

| India VIX | 11.25 (Low Volatility) | 11.25 (Low Volatility) |

| Put-Call Ratio (PCR) | 1.09 (Slightly Bullish) | 0.97 (Neutral) |

📊 Sector Performance

| Sector | Performance |

|---|---|

| IT | +0.75% |

| Banking | -0.15% |

| FMCG | +0.22% |

| Auto | +0.38% |

| Realty | -0.40% |

🎯 Trading Strategy for 08/7/25

Intraday Strategy

- Nifty: Buy on dip near 25,400 with SL at 25,360 and target 25,500.

- Bank Nifty: Long above 57,050 with SL at 56,870 and target 57,250.

Swing Strategy

- Maintain bullish bias if Nifty holds above 25,480 on daily close.

- Bank Nifty may see fresh uptrend above 57,300. Wait for breakout confirmation.

📌 Key Levels for July 8, 2025

| Index | Support | Resistance |

|---|---|---|

| Nifty | 25,360 | 25,520 |

| Bank Nifty | 56,700 | 57,250 |

🧠 Final Thoughts

Both indices stayed in tight ranges with limited momentum. However, chart-based signals performed well with timely entries and exits. As we step into July 8, expect stock-specific action driven by Q1 results and global cues. Continue using our Free Buy-Sell Chart and the TradingView Strategy to stay ahead of the market curve.

📌 Disclaimer

This analysis is for educational and informational purposes only. It does not constitute investment advice. Please consult a SEBI-registered advisor before taking any position.