Nifty & Bank Nifty Analysis – 01 July 2025 | Strategy for 02 July

On 01 July 2025, both Nifty 50 and Bank Nifty traded within tight ranges.

Global cues like the Iran oil conflict and U.S. interest rate expectations kept traders cautious.

Let’s dive into the charts, key levels, and a practical trading strategy for 02 July 2025.

🔑 Key Highlights

- Nifty closed at 25,533 (–0.02%)

- Bank Nifty ended at 57,442.70 (–0.01%)

- Low volatility session; India VIX at 12.11

- Oil prices jumped amid Iran tensions

- FIIs sold ₹1,256 Cr; DIIs remained net buyers

📉 Price Action Overview

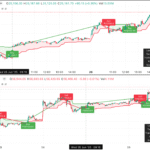

Nifty 50

IAFL gave a buy signal at 25,538.15 followed by a sell near 25,590.4.

The index failed to break above the previous highs and remained sideways for the rest of the session.

Bank Nifty

Bank Nifty opened flat. IAFL triggered a sell at 57,534, then buy signals at 57,205.95 and 57,360.5.

The last trade is still active with a profit of ₹82.2.

📊 Sector Performance

| Sector | Change | Top Gainer |

|---|---|---|

| IT | +0.86% | TCS |

| Auto | +0.55% | Maruti |

| Pharma | –0.43% | Sun Pharma |

| Banking | Flat | ICICI Bank |

📐 Technical Summary

| Indicator | Nifty | Bank Nifty |

|---|---|---|

| RSI (14) | 46 | 52 |

| Support | 25,500 / 25,420 | 57,200 / 57,000 |

| Resistance | 25,600 / 25,675 | 57,650 / 57,900 |

| India VIX | 12.11 (Low volatility) | |

| PCR (Open Interest) | 0.89 | |

🌍 Global Cues

Crude oil surged due to Iran seizing a vessel in the Strait of Hormuz

(FXStreet report).

Higher oil may increase inflation pressure in India.

Investors are watching for U.S. Fed minutes expected this week.

FII-DII data shows a mild risk-off tone.

📈 Trading Strategy for 02 July 2025

Intraday Setup

- Nifty: Buy above 25,600 → Targets: 25,675 / 25,720 | SL: 25,520

- Nifty: Sell below 25,500 → Targets: 25,460 / 25,420 | SL: 25,580

- Bank Nifty: Buy above 57,500 → Targets: 57,650 / 57,800 | SL: 57,200

- Bank Nifty: Sell below 57,200 → Targets: 57,050 / 56,880 | SL: 57,420

Swing Trade View

- Nifty: Bullish above 25,675 → Target: 25,950 | Stop: 25,420

- Bank Nifty: Hold long above 57,500 → Target: 58,400 | Stop: 56,990

🔗 Useful Sources

📝 Conclusion

Market remains range-bound with low volatility.

Watch for a breakout near key support/resistance levels.

Global cues like oil and Fed comments may cause quick moves.

📢 Disclaimer

This report is for educational purposes only. It is not financial advice.

Please consult a SEBI-registered advisor before making any trading decisions.

Trade responsibly. Markets carry risk.