🔍 Key Takeaways

- Nifty 50 closed at 25,444.75, down just 0.01 %.

- Bank Nifty finished at 56,972.15 after a late recovery.

- Both indices flashed fresh buy signals, but intraday targets stayed elusive.

- Crude prices jumped on rising Iran tensions; global sentiment is cautious.

- India VIX remains low, yet event‑driven spikes are possible.

📊 Price Action Breakdown – 5‑Minute Chart

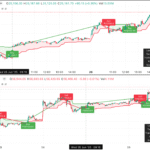

Nifty 50

The index traded in a narrow band for most of the session. A buy signal at 25,456.65 carried a stop‑loss at 25,388.97 and a target of 25,592.01, but price stalled, ending with a modest ‑11.9 pts unrealised.

Bank Nifty

Bank Nifty saw a noon pullback flip into buying momentum. The system triggered a buy at 57,055.10 against a stop‑loss of 56,875.37 with a 57,414.71 target. The close at 56,972.15 left an ‑83 pts drawdown, but trend strength improved.

🌍 Global Macro Recap

- Brent crude neared USD 87 after drone strikes in Iran, rekindling supply fears (Reuters).

- Nasdaq slipped as weak tech earnings weighed, while the Dow ended flat (Investing.com).

- Asian peers consolidated; Nikkei and Hang Seng closed almost unchanged (FXStreet).

- USD/INR hovered near 83.10, offering currency stability (Moneycontrol).

📈 Indicator Dashboard

| Indicator | Nifty 50 | Bank Nifty |

|---|---|---|

| RSI (14) | 47 – Neutral | 52 – Mild Bullish |

| India VIX | 12.10 – Low Vol | |

| PCR | 0.98 | 1.05 |

🏛️ Sector Performance Snapshot

For real‑time signals across sectors, bookmark our Free Buy‑Sell Chart.

| Sector | Move (%) |

|---|---|

| IT | ‑0.35 |

| FMCG | +0.20 |

| Banking | +0.02 |

| Auto | +0.10 |

🎯 Strategy for 03 July 2025

📌 Intraday Plan

- Buy Nifty on early pullbacks to 25,400–25,420 if volume confirms. Automate with our TradingView Indicator.

- Watch Bank Nifty basing around 57,000–57,050; a burst above 57,200 can reach 57,400 quickly.

- Keep stops tight; VIX is low but can spike on geopolitical headlines.

📌 Swing View (3‑5 Days)

- Accumulating select PSU banks and auto names looks favourable while crude trends higher.

- Stay nimble—rotate into FMCG/Pharma if risk sentiment sours.

- Monitor India VIX and crude to manage exposure.

📌 Key Levels for Tomorrow

| Index | Support | Resistance | Breakout |

|---|---|---|---|

| Nifty 50 | 25,390 | 25,600 | 25,650 |

| Bank Nifty | 56,800 | 57,400 | 57,500 |

🧠 Final Thoughts

The primary up‑trend is intact, but rising crude and Iran tensions warrant caution. Stay disciplined with position sizes. For hands‑on charts during the session, keep the Free Buy‑Sell Chart open alongside your broker terminal.

📢 Disclaimer

This content is for education only. Markets are risky; consult a licensed adviser before trading.