Nifty 50 & Bank Nifty Post-Market Analysis for 30 June 2025

The Indian stock market ended the June 30, 2025 session on a cautious note, as both Nifty 50 and Bank Nifty witnessed minor corrections post a volatile intra-day movement. This post provides a detailed technical breakdown based on the 5-minute TradingView chart, global cues, and a trading roadmap for the upcoming session on 01 July 2025.

📌 Key Takeaways

- Nifty 50 closed at 25,507.45, down -14.95 points (-0.06%).

- Bank Nifty ended at 57,278.15, down -48.65 points (-0.08%).

- Intraday trend was largely range-bound with selling pressure visible after mid-session.

- Technical indicators suggest an early-week consolidation or mild correction.

🧾 Price Action Breakdown

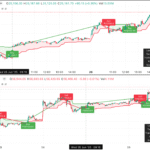

Nifty 50 (5-Minute Chart)

Nifty opened flat and faced early resistance at around 25,596.95 before reversing. The last visible SELL signal was generated at 25,596.95, with the price eventually dipping to sub-25,500 levels. The stop loss for the trade was placed at 25,658.21 and target at 25,474.42, giving a P/L of 89.5 points.

Bank Nifty (5-Minute Chart)

Bank Nifty followed a similar pattern, showing strength till mid-day and then giving a SELL signal at 57,354.25. The trade yielded a modest P/L of 65.5 points with the stop loss at 57,485.05 and a target of 57,060.86.

📊 Sector Performance on 30 June 2025

| Sector | Change (%) | Trend |

|---|---|---|

| IT | +0.38% | Bullish |

| Auto | +0.15% | Sideways |

| Banking | -0.25% | Bearish |

📈 Technical Indicators Summary

| Indicator | Nifty | Bank Nifty |

|---|---|---|

| RSI (14) | 47 (Neutral) | 44 (Slightly Bearish) |

| India VIX | 13.45 (Stable) | |

| Put Call Ratio (PCR) | 0.92 (Balanced) | |

🌐 Macro & Global Market Update

- US markets ended mixed on Friday amid continued uncertainty over the Fed’s stance on interest rates.

- Brent crude rose 1.4% to $88.20 as tensions in the Strait of Hormuz escalated due to Iranian naval maneuvers, raising inflation fears.

- Rupee remained flat at 83.10 against the USD, showing resilience amid global volatility.

- European equities remained cautious as France and Germany posted weaker-than-expected manufacturing data.

- Gold prices surged to $2,072/oz as investors moved to safe havens.

🛠️ Trading Strategy for 01 July 2025 (Tuesday)

📍 Intraday Strategy

- Nifty 50: Sell below 25,450 for targets of 25,375 and 25,280. SL at 25,590.

- Bank Nifty: Sell below 57,200 for targets of 57,000 and 56,850. SL at 57,450.

- Wait for confirmation with volume spike before entering trades. Avoid over-leveraging near support zones.

📦 Swing Setup (2–5 Days)

- Nifty: Bearish below 25,300 with downside potential up to 25,000.

- Bank Nifty: Consolidation expected between 56,800–57,800. Breakout trade possible above 58,000.

🔍 Support and Resistance Levels

| Index | Support | Resistance |

|---|---|---|

| Nifty 50 | 25,300 / 25,200 | 25,600 / 25,720 |

| Bank Nifty | 57,000 / 56,750 | 57,500 / 57,880 |

✅ Final Thoughts

The 30 June 2025 session closed with signs of short-term fatigue in both Nifty and Bank Nifty. Despite a strong June series overall, traders must remain cautious as we step into the July series amid rising global tensions and a cautious RBI outlook.

Tomorrow’s strategy should be based on the first 15-minute candle confirmation along with global cues from overnight US sessions.

📌 Disclaimer

This analysis is purely educational and not financial advice. Please consult your financial advisor before making any trading decisions. All data used is for illustrative purposes only.