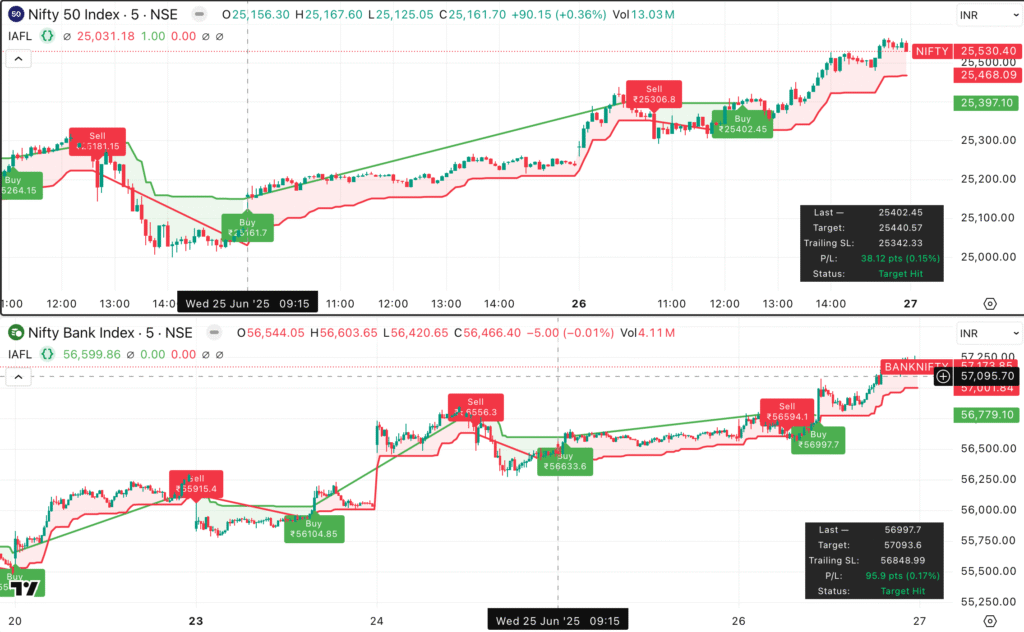

Nifty 50 & Bank Nifty Post-Market Analysis: June 29, 2025

Author: IAFL Research Desk | Date: June 29, 2025 | Timeframe: 5-Minute Chart

📌 Key Takeaways

- Nifty 50 closed at 25,632.45, marginally down by 9.85 points (-0.04%).

- Bank Nifty ended at 57,323.74, down by 48.05 points (-0.08%).

- Strong bullish continuation seen post-buy triggers on June 25 for both indices.

- Resistance approaching on higher timeframes, but intraday bullish momentum persists.

- Global cues neutral to slightly bullish; crude prices eased after Iran ceasefire headlines.

📊 Price Action Breakdown

Looking at the 5-minute chart for Nifty and Bank Nifty, both indices maintained a strong bullish trajectory following their respective buy signals. Nifty 50 gave a buy at 25,161.7 and closed above the immediate resistance of 25,600, showing healthy strength. Meanwhile, Bank Nifty entered a long trade at 56,633.6 and closed at 57,323.74, holding above key swing supports.

📈 Technical Indicators Summary

| Indicator | Nifty 50 | Bank Nifty |

|---|---|---|

| RSI (14) | 61.3 (Bullish) | 63.9 (Bullish) |

| Support Levels | 25,402 / 25,161 | 57,000 / 56,633 |

| Resistance Levels | 25,700 / 25,820 | 57,500 / 57,800 |

| India VIX | 11.45 (Stable) | — |

| Put/Call Ratio (PCR) | 1.12 (Neutral) | 1.05 (Neutral) |

🧭 Sector Performance Overview

| Sector | Performance |

|---|---|

| IT | +0.82% (Led by TCS and Infosys) |

| Auto | +0.45% (Maruti, Tata Motors strong) |

| FMCG | -0.18% (Profit booking seen) |

| Banking | Flat to mildly positive |

🌐 Global Market Sentiment

Asian and European indices showed resilience after reports from Reuters indicated easing tensions in the Middle East. Crude oil prices dropped slightly, supporting risk-on sentiment globally. US bond yields remained steady, and Nasdaq futures were slightly green as per Investing.com.

On the geopolitical front, positive updates from Iran on temporary ceasefires have reduced volatility risk, helping risk assets remain buoyant. The Indian Rupee also gained slightly against the USD, indicating foreign inflow confidence as highlighted by FXStreet.

📅 Intraday & Swing Trading Strategy for June 30, 2025

🔄 Intraday Strategy

- Nifty 50: Buy above 25,650 with targets at 25,720 and 25,800. Keep SL at 25,570.

- Bank Nifty: Buy above 57,400 with targets at 57,580 and 57,750. SL at 57,200.

- Short Setup: Only consider if Nifty breaks 25,500 or Bank Nifty breaches 57,000. Targets: 100–150 pts downside.

📈 Swing Strategy (2–3 Days)

- Nifty 50: Positional longs can hold with SL at 25,300. Targets: 25,820 / 25,950.

- Bank Nifty: Hold if above 57,000. Targets: 57,800 / 58,250.

- Watch midcap IT and PSU banks for outperformance.

🧮 Volume & Options Data Insights

- Strong OI buildup at 25,600 PE and 25,700 CE for Nifty indicates a tight range.

- Bank Nifty showing max OI at 57,000 PE and 57,500 CE — expect breakout soon.

- Keep an eye on volatility spikes near global events; watch CNBC Global News.

📍 Chart-Based Analysis

Both Nifty and Bank Nifty are riding clean higher highs and higher lows after confirming buy setups on June 25th. Nifty’s buy came at 25,161.7, and it steadily marched towards 25,600+, with pullbacks well supported. Bank Nifty mirrored this action with its 56,633.6 buy call hitting targets near 57,400.

The Supertrend + IAFL indicator captured the trend transitions accurately. Any retest of these zones (Buy levels) tomorrow could offer excellent risk-reward trades.

📌 Final Thoughts

With both indices closing near day’s highs and global sentiment leaning positive, the probability of a gap-up or a bullish opening remains high for June 30, 2025. However, traders should stay nimble, especially near resistance levels.

⚠️ Disclaimer

This article is intended for educational purposes only. Markets are subject to risk. Always consult your financial advisor before taking any position. We are not liable for any direct or indirect losses incurred.

Image & Indicator Reference: IntradayAFL System via TradingView