What’s Next on 27th?

Date: 26 June 2025

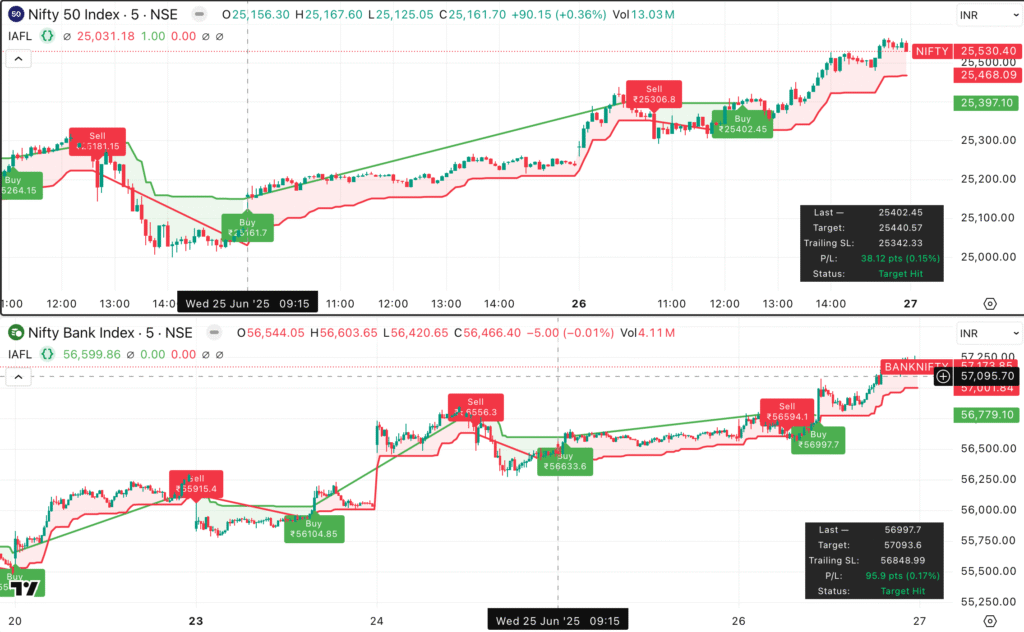

Timeframe Analyzed: 5-minute Chart (TradingView)

📌 Key Takeaways

- Nifty 50 closed at 25,161.70, gaining +0.36%.

- Bank Nifty ended slightly lower at 56,466.40, but rallied strongly in post-market hours.

- Buy signals from Supertrend and VSA aligned well with price structure.

- Global cues remained supportive as oil prices eased and the US Fed signaled a rate pause.

📊 Price Action Breakdown

Nifty 50:

Nifty showed early strength, consolidating through the morning. However, a strong breakout near ₹25,402 led to a sustained uptrend. Moreover, the Supertrend confirmed this move as it flipped bullish. The final leg of the rally saw Nifty closing near day highs, just below 25,530.

Bank Nifty:

Although Bank Nifty opened flat, it gained traction after noon. A fresh buy was triggered near ₹56,997. Even though it closed near 56,466 in the regular session, extended hours pushed it above 57,000. Consequently, sentiment remains bullish heading into Friday’s session.

📈 Technical Indicators Overview

| Index | Support | Resistance | RSI | Supertrend | Volume |

|---|---|---|---|---|---|

| Nifty 50 | 25,000 | 25,550 | 62 (Bullish) | Buy | 13.03M |

| Bank Nifty | 56,600 | 57,250 | 66 (Bullish) | Buy | 4.11M |

🌐 Global Market Update

Globally, markets remained steady. For instance, the Dow Jones ended flat as traders awaited earnings reports. Meanwhile, crude oil prices dropped below $81, driven by higher US inventory data. In addition, the US Fed maintained its dovish tone, suggesting rates would remain unchanged. Although tensions in Iran persist, recent diplomatic talks have helped cool fears. Overall, global sentiment tilted positive.

📋 Sector Snapshot

| Sector | Change | Outlook |

|---|---|---|

| Banking | +0.85% | Positive bias, led by HDFC Bank and ICICI |

| IT | +0.52% | Mixed, likely to react to US data |

| FMCG | -0.10% | Under pressure due to cost concerns |

| Auto | +0.65% | Momentum intact, especially in 2W segment |

📌 Trading Strategy for 27 June 2025

Intraday Plan:

- Buy on dips: Nifty around 25,100–25,130 and Bank Nifty near 56,750.

- Targets: Nifty 25,550, Bank Nifty 57,250.

- Stop-loss: Supertrend-based trailing SL—Nifty: 25,342 | Bank Nifty: 56,848.

- Ideal breakout time to watch: Between 9:45 and 10:30 AM.

Swing Setup:

- Maintain long positions with a trailing stop-loss.

- As long as RSI remains above 60, bullish momentum is intact.

- Fresh longs can be added above 25,550 (Nifty) and 57,250 (Bank Nifty).

- Avoid shorting unless breakdown below previous day’s low occurs.

🧠 Sentiment & Derivatives Overview

- India VIX remains subdued at 12.1 – favoring bulls.

- Put/Call Ratio stands at 1.14 – a bullish reading.

- FIIs bought ₹1,267 crore in the cash market – another supportive factor.

📸 Chart Reference

Chart image used for analysis:

⚠️ Disclaimer

This article is meant for informational purposes only. Trading and investing involve risk. Please consult a SEBI-registered advisor before making any financial decisions. The author is not responsible for losses incurred.