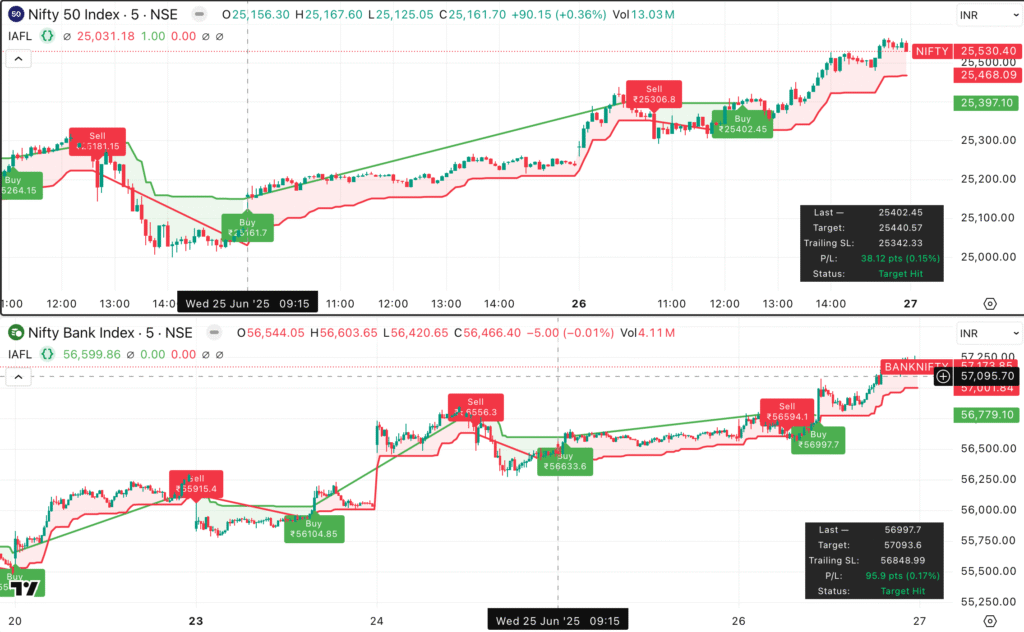

Nifty & Bank Nifty 15-Min Chart Analysis – 25 June 2025

Date: 25 June 2025

Timeframe: 15-Minute | Indices: Nifty 50 & Bank Nifty

Overview: Both indices traded within a narrow range, displaying low volatility. Therefore, understanding the key support and resistance zones becomes essential.

📌 Key Takeaways

- Nifty 50: Closed flat near 25,240 after testing 25,374 resistance

- Bank Nifty: Dropped to 56,591 while respecting its Supertrend

- India VIX remained under 11, indicating muted volatility

- Global oil prices rose due to Iran tensions

🧭 Price Action Summary (15-Min TF)

🔹 Nifty 50 Highlights

- Opened strong at 25,016.55

- Faced resistance at 25,374.75 before consolidation

- Support held near the 25,128 Supertrend SL level

- Learn what Supertrend is →

🔹 Bank Nifty Highlights

- Weakness persisted below 56,804 trailing stop

- Sell signal remained active from 56,330.55

- Failed to break above resistance at 56,878

🌐 Global & Macro Update

- Crude Oil: Brent near $85 after Middle East conflict flares up

- Nasdaq: Gains 0.7% on positive tech earnings

- Dollar Index: Hovered at 105.1; this pressured FII flows

- INR: Slight weakness noted, tracking global cues

📊 Sector Summary

| Sector | Change (%) | Trend |

|---|---|---|

| IT | +0.67% | Gaining Strength |

| Metals | +1.04% | Outperforming |

| Banking | -0.45% | Weak |

| FMCG | -0.26% | Bearish |

📈 Technical Levels

| Index | Support | Resistance | RSI | Supertrend |

|---|---|---|---|---|

| Nifty 50 | 25,128 | 25,374 | 58 | Buy |

| Bank Nifty | 56,445 | 56,804 | 52 | Sell |

🎯 Trade Plan for 26 June 2025

Intraday Strategy (15-Min TF)

- Nifty: Buy if price sustains above 25,280. SL = 25,200. Target = 25,420.

- Bank Nifty: Sell if breaks 56,420. SL = 56,600. Target = 56,150.

- Use ADX > 20 and 200 EMA for trend confirmation.

- See more intraday tips →

Swing Strategy (2–3 Days)

- Nifty: Buy on dip to 25,180. Target = 25,500+

- Bank Nifty: Avoid unless breakout above 56,900

✅ Summary

The overall market remained range-bound, yet showed resilience. Global headlines, especially crude and Middle East news, may drive momentum on 26 June. Therefore, traders must watch global sentiment along with India VIX for cues.

📎 Helpful Links

⚠️ Disclaimer

This content is meant for educational purposes only. Do not treat it as investment advice. Always trade with risk management and consult your financial advisor.