Nifty & Bank Nifty Post-Market Analysis for 24 June 2025 | Strategy for 25 June

Date: 24 June 2025

Index Analyzed: Nifty 50, Bank Nifty

Timeframe: 5-minute

📌 Key Takeaways from 24 June 2025

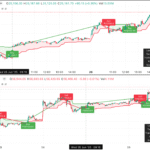

- Nifty 50 closed marginally positive at 25,071.55 (+2.15 points), showing resilience after mid-day profit booking.

- Bank Nifty showed volatility but closed slightly negative at 56,471.40 (-19.45 points), recovering from intra-day lows.

- Both indices respected support zones with clear intraday buy/sell signals based on Supertrend and price action.

- Global market sentiment remained cautious amid rising crude oil and Middle East tensions.

📊 Price Action Breakdown (5-Minute Chart)

Nifty 50: After opening near 25,069.65, Nifty consolidated around 11:30 AM, triggered a buy signal at ₹24,942.7, and rallied to ₹25,264.15 before mild profit booking. The final sell signal at ₹25,181.15 confirmed a short-term top.

Bank Nifty: Bank Nifty showed strong upward momentum post-12:45 PM after a buy trigger at ₹56,104.85. However, it faced resistance at ₹56,812 and gave a sell at ₹56,556.3, later stabilizing above ₹56,400 in the second half.

🧭 Technical Levels & Indicators

| Index | Support | Resistance | RSI | PCR | VIX |

|---|---|---|---|---|---|

| Nifty 50 | 24,900 | 25,250 | 52 (Neutral) | 1.05 (Stable) | 11.12 |

| Bank Nifty | 56,100 | 56,900 | 49 (Mildly Bearish) | 0.98 (Cautious) | 11.12 |

🏛️ Sector Performance

| Sector | Performance | Remarks |

|---|---|---|

| IT | +1.25% | Supported by US Tech recovery |

| FMCG | +0.78% | Defensive buying seen |

| Banking | -0.15% | Profit booking in private banks |

| Auto | +0.33% | Steady demand optimism |

| Energy | -0.58% | Crude oil price pressure |

🌍 Global & Macro Update

- Brent Crude rose above $89/barrel amid Middle East geopolitical tensions, increasing inflation fears.

- US Markets closed slightly lower: Nasdaq -0.26%, Dow -0.14% — risk-off tone persists (source).

- USDINR traded near 83.40, pressuring import-heavy sectors (FXStreet).

- India VIX remains low at 11.12, indicating reduced fear levels despite global cues (NSE Option Chain).

- FII activity remained neutral with light net buying; DII supported the late session recovery (Investing.com).

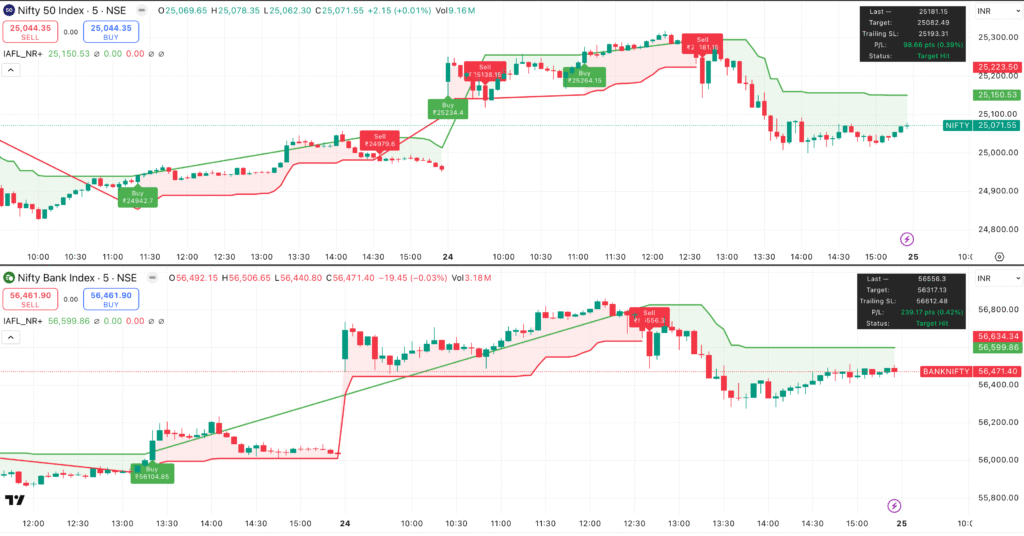

📈 Trading Strategy for 25 June 2025

🔹 Intraday Strategy (5-min Chart)

- Nifty: Watch for support at 24,980. Intraday breakout above 25,200 may lead to quick 50–70 pts move.

- Bank Nifty: A sustained move above 56,600 may attract buying towards 56,900. Breakdown below 56,300 could trigger selling.

- Indicators to Watch: 20 EMA crossover, Supertrend (10, 3), Volume spikes, and RSI divergence.

- Use tight stop-losses and respect volatility near major zones.

🔹 Swing Strategy (1-Hour or Daily Chart)

- Nifty Swing Range: 24,850 – 25,400

- Bank Nifty Swing Range: 55,800 – 57,200

- Wait for breakout candles with volume confirmation for entries.

- Carry forward positions only after EOD trend confirmation with macro alignment.

🛡️ Disclaimer

This article is purely educational and should not be construed as investment advice. Please consult a SEBI-registered financial advisor before making any trading decisions. Trading in the stock market involves risks, and past performance does not guarantee future results.