Quick snapshot

- Gold trades near $4,000 after hitting a record this month.

- Silver hovers near $49 after a strong year-to-date rally.

- MCX gold saw sharp swings between ₹1.18–1.27 lakh per 10g in late October.

- MCX silver hit a record near ₹1.70 lakh/kg in October before easing.

Why prices surged

Gold climbed on safe-haven demand and rate cut hopes.

Central bank buying and a softer dollar at times helped.

Silver gained from both macro tailwinds and industrial demand.

Profit-taking after records raised short-term volatility.

Global context

Gold set fresh highs in October, then pulled back to retest $4,000.

Industry and bank outlooks still point to higher averages into 2026.

Polls even show scenarios near $5,000 over 12 months.

Short-term moves now track the dollar, yields, and Fed tone.

India market today

City quotes showed brisk moves in 24K prices this week.

Recent per‑10g quotes clustered around ₹1.20–1.23 lakh.

On MCX, December gold tested ₹1.18–1.21 lakh in recent sessions.

Silver spot in Delhi hovered near ₹1.51 lakh/kg, below the monthly peak.

Key drivers to watch

- Fed policy shifts that move the dollar and US yields.

- Geopolitical risk that sparks safe-haven flows.

- ETF flows that confirm or reject trend strength.

- India’s seasonal demand from festivals and weddings.

- Industrial demand that supports silver on upswings.

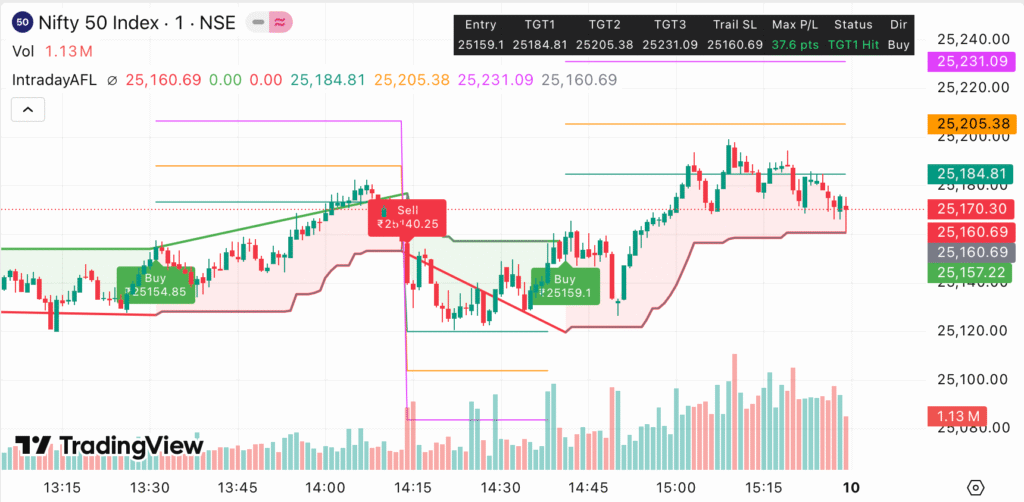

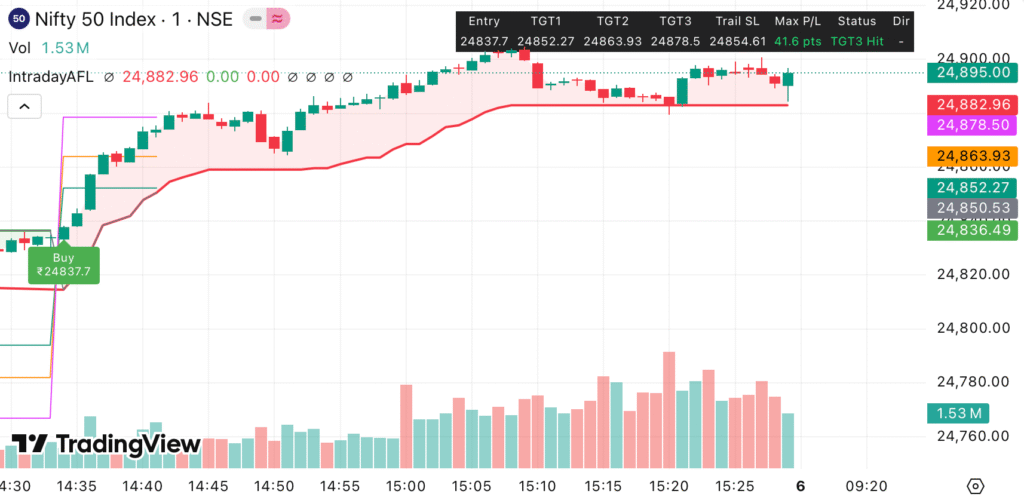

Two-week view: Gold (MCX)

Bias stays buy‑on‑dips while spot holds near $4,000 and MCX stays above ₹1.18 lakh.

Immediate support sits near ₹1,18,000 per 10g, the late‑October low area.

First resistance is near ₹1,25,000, then a stretch toward ₹1,27,000 on momentum.

A clean break below ₹1,18,000 can open a slide toward ₹1,16,500.

A firm dollar or hawkish hints can cap rallies during data-heavy days.

Two-week view: Silver (MCX)

Momentum cooled after the ₹1.70 lakh/kg spike, but trend strength is intact.

Support sits around ₹1.50–1.52 lakh/kg, near current spot references.

Resistance stands around ₹1.65–1.70 lakh/kg, the recent record zone.

Industrial demand and gold correlation keep silver reactive on data days.

Watch gold‑silver spreads on sharp macro headlines.

Event calendar cues

- US jobs, ISM, and CPI steer yields and bullion flows.

- Fed speakers can swing the dollar and metals.

- India’s post‑festival and wedding buying can firm dips.

- China growth and trade headlines can flip risk sentiment.

Clean table (mobile friendly)

| Contract | Support zone | Pivot | Resistance zone | Notes |

|---|---|---|---|---|

| MCX Gold Dec | ₹1,18,000–1,18,500 | ₹1,22,000 | ₹1,25,000–1,27,000 | Support aligns with recent intraday low range |

| MCX Silver Dec | ₹1,50,000–1,52,000 | ₹1,58,000 | ₹1,65,000–₹1,70,000 | Resistance aligns with October record zone |

Strategy ideas

- Trade the range: Fade extremes near support and resistance with tight stops.

- Use triggers: Enter on breakouts or strong rejections of levels.

- Size for swings: Volatility is high, so keep risk small per trade.

- Watch the dollar: If DXY firms, trim longs and wait for dips.

- Stagger targets: Scale out near mid‑range and key barriers.

What could change the trend

A firmer Fed path and sticky inflation can slow the rally near $4,000.

A softer dollar and steady ETF inflows can fuel upside bursts.

A growth scare could lift gold faster than silver in the short run.

A hot industrial cycle can make silver lead on rebounds.

Heavy profit‑taking can cause sharp air pockets intraday.

Macro and flow signals

LBMA delegates projected levels near $5,000 over 12 months.

Polls show 2026 averages above $4,000 for the first time.

Big banks project higher medium‑term ranges into 2026.

Yet, some cut short‑term targets after the record spike.

Use those ranges as a backdrop, not tight signals.

City prices and MCX checks

City sheets showed fast 24K price changes this week in metros.

Recent 24K quotes centered near ₹1.20–1.23 lakh per 10g.

MCX gold dipped to ~₹1,18,000 per 10g during a sharp session.

Silver sits near ₹1.51 lakh/kg in Delhi spot today.

MCX silver’s record reached about ₹1.70 lakh/kg this month.

Practical checklist for MCX traders

- Mark levels: ₹1.18 lakh support in gold; ₹1.65–1.70 lakh silver cap.

- Track headlines: Fed talk, CPI, and yields shift momentum fast.

- Respect gaps: Big gaps need smaller sizes and wider stops.

- Confirm with spreads: Watch gold‑silver and INR cross‑currents.

- Avoid overtrading: Wait for clean signals at range edges.

Fast links for tools

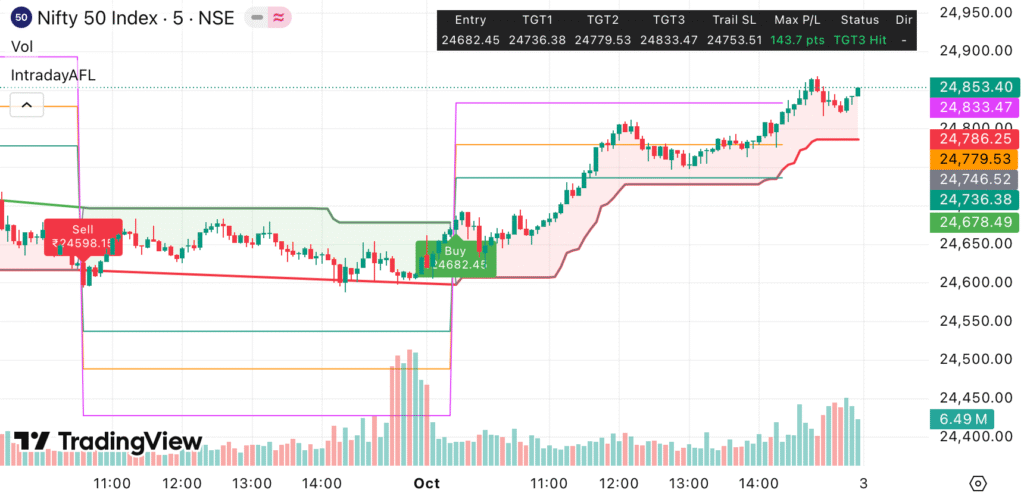

- Free Buy‑Sell Chart: https://intradayafl.online/index.php/free-live-buy-sell-signal/

- TradingView Indicator: https://intradayafl.online/index.php/tradingview/

- Hero Zero Option Calls (2–5X): https://t.me/IntradayAFL_Subscription_Bot

Scenario planner: next two weeks

- Base case gold: Sideways‑to‑up with dips bought above ₹1.18 lakh.

- Bull case gold: Dollar cools and Fed softens; ₹1.27 lakh retest.

- Bear case gold: Dollar firms and data beats; test ₹1.16–1.18 lakh.

- Base case silver: Hold above ₹1.50 lakh; probe ₹1.62–1.65 lakh.

- Bear case silver: Break ₹1.50 lakh; risk a slide to mid‑₹1.40s.

FAQs

Will gold reclaim its record soon in India?

Global views lean higher into next year, but expect zig‑zags first.

A soft dollar and steady flows can drive a retest on strong days.

Is silver set to lead again?

Silver can outpace gold on industrial optimism, but swings will be wild.

Watch ₹1.50 lakh support and reactions near ₹1.65–1.70 lakh.

What are the top risks to this view?

Hawkish Fed signals, a firm dollar, or hot data can cap rallies.

A sharp risk‑off may lift gold first and weigh on silver later.

Bottom line

Trend strength is intact, but trade the range with respect for volatility.

Mark the ₹1.18–1.27 lakh gold band and ₹1.50–1.70 lakh silver band.

Use live signals and clear rules to avoid noise in fast markets.

Keep positions small and trail profits on every strong move.

Disclaimer: Markets involve risk; levels and views are for education, not advice.

Always use stops and size positions to your risk tolerance on MCX.