Nifty & Bank Nifty Extend Rally on Fed Rate Cut: Post-Market Analysis & Tomorrow’s Trading Strategy

The Indian equity markets delivered another impressive performance on September 18, 2025, marking the third consecutive session of gains. Furthermore, the US Federal Reserve’s 25 basis point rate cut to 4.00%-4.25% range provided the much-needed catalyst for global risk assets. Additionally, Nifty 50 closed at 25,423.60 with a gain of 93.35 points (0.37%), while Bank Nifty surged 234.15 points to close at 55,727.45 (0.42%). Moreover, the Sensex added 320.25 points to settle at 83,013.96, demonstrating broad-based market strength.

Most importantly, pharmaceutical and IT sectors emerged as standout performers, with Nifty Pharma surging 1.50% and Nifty IT gaining 0.83%. Consequently, the India VIX dropped to 9.89, indicating reduced market volatility and improved investor confidence. Meanwhile, FII activity turned positive with net buying of ₹366.69 crores, while DIIs continued their strong support with ₹3,326.56 crores of net purchases.

Price Action Breakdown (Nifty and Bank Nifty)

Nifty 50 Technical Analysis

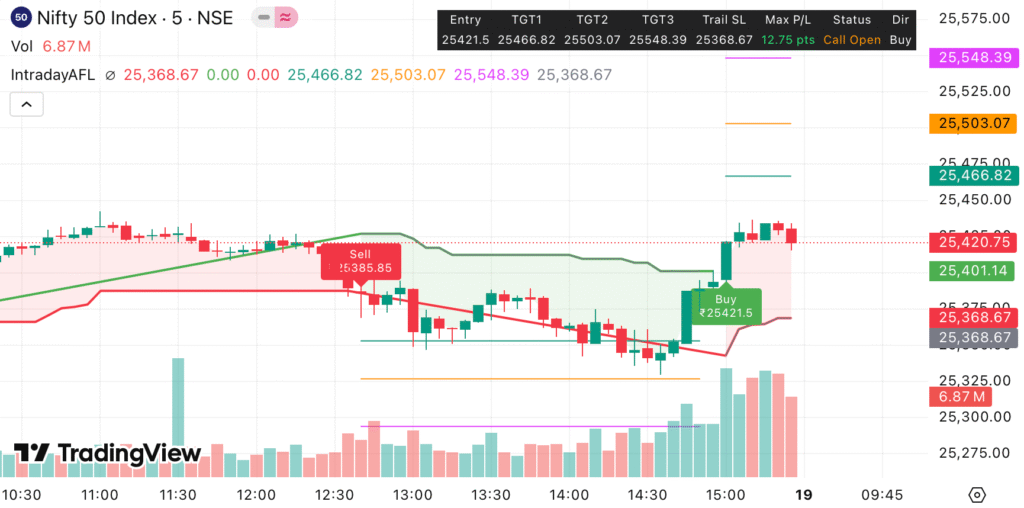

The Nifty 50 demonstrated resilient price action throughout the session. Initially, the index opened at 25,330.25 and reached an intraday high of 25,448.95. Subsequently, it maintained strength above key moving averages, indicating bullish momentum continuation. The RSI stands at 66.15, well below the overbought zone of 70, suggesting room for further upside.

Importantly, the index has formed a higher top and higher bottom pattern, signaling positive trend continuation. Moreover, Nifty is trading above all major exponential moving averages (20, 50, 100, and 200 EMA), confirming the bullish structure. Additionally, the daily chart shows strong support at the 25,300 level, which coincides with recent swing lows.

Bank Nifty Performance Review

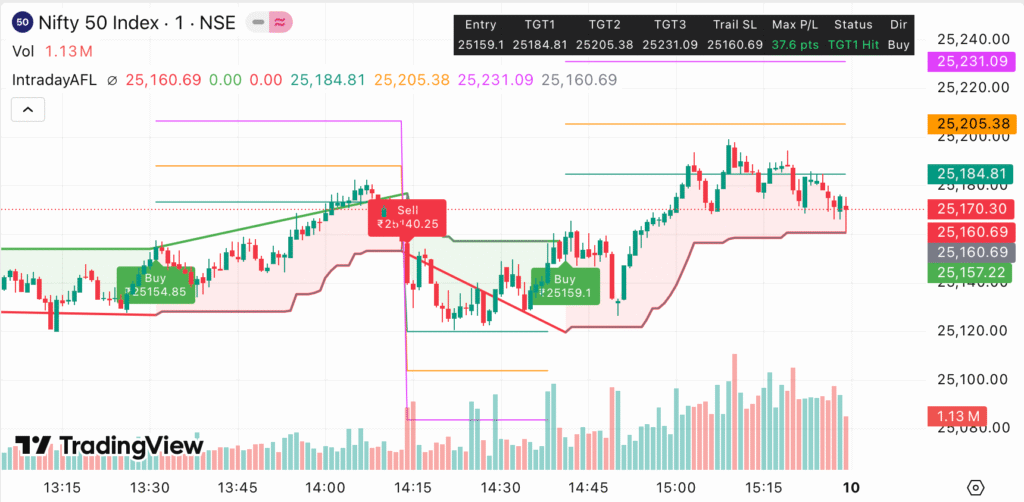

Bank Nifty showcased exceptional strength, recording an impressive 11th consecutive session of gains. The index opened at 55,797.10 and touched a high of 55,835.25 during the session. Nevertheless, it managed to close near session highs at 55,727.45, indicating sustained buying interest.

The RSI for Bank Nifty stands at 59.78, providing ample room for further appreciation without entering overbought territory. Furthermore, the index is trading above all key EMAs, with strong support emerging at 55,200 levels. Additionally, the weekly chart pattern remains constructive, supporting the bullish outlook for banking stocks.

Global Market and Macro Updates

Federal Reserve Rate Cut Impact

The US Federal Reserve delivered its first rate cut of 2025, reducing the federal funds rate by 25 basis points. Significantly, Fed Chair Jerome Powell indicated the possibility of two more quarter-point cuts in 2025, providing additional liquidity support for emerging markets. However, Powell emphasized that future cuts are not guaranteed and will depend on economic data.

The Fed’s dot plot revealed considerable disparity among policymakers, with nine participants forecasting one more cut while ten anticipated two additional reductions. Meanwhile, the central bank maintained its commitment to achieving maximum employment while targeting 2% inflation.

Global Markets Reaction

Global markets responded positively to the Fed’s accommodative stance. The Dow Jones gained 0.78%, while the Nasdaq closed marginally lower amid mixed sentiment. Similarly, European markets showed strength, with the DAX surging 1.11% and the CAC gaining 0.70%.

Asian markets also participated in the rally, with Japan’s Nikkei advancing 1.15%. However, the Hang Seng declined 1.35%, reflecting concerns about Chinese economic growth. Consequently, the positive global sentiment provided strong support for Indian equities.

Currency and Commodity Impact

The US Dollar Index strengthened 0.38% following Powell’s cautious commentary about future rate cuts. Meanwhile, gold prices reached new all-time highs before settling 0.82% higher at $3,659.10 per ounce. Additionally, crude oil prices declined on concerns about demand, with Brent crude falling 0.3% to $68.30 per barrel.

Technical Indicator Table

| Indicator | Current Level | Previous Close | Signal |

|---|---|---|---|

| RSI – Nifty | 66.15 | 63.50 | Bullish |

| RSI – Bank Nifty | 59.78 | 57.20 | Bullish |

| India VIX | 9.89 | 10.25 | Low Volatility |

| PCR (Put Call Ratio) | 1.09 | 1.16 | Neutral-Bullish |

The technical indicators paint a constructive picture for both indices. The India VIX at 9.89 represents a near one-year low, indicating extremely low volatility expectations. This suggests that investors are confident about market stability, though it may also indicate some complacency. The PCR at 1.09 shows a slight decline from previous levels, suggesting reduced put buying and improved bullish sentiment.

Sector Performance Table

| Sector | Performance (%) | Status | Outlook |

|---|---|---|---|

| Nifty Pharma | +1.50 | Top Gainer | Positive |

| Nifty IT | +0.83 | Strong Gainer | Positive |

| Nifty Private Bank | +0.44 | Gainer | Neutral-Positive |

| Nifty FMCG | +0.36 | Modest Gainer | Neutral |

| Nifty Auto | +0.13 | Marginal Gainer | Neutral |

| Nifty Media | -0.30 | Laggard | Cautious |

| Nifty PSU Bank | -0.16 | Underperformer | Neutral |

Pharmaceutical stocks emerged as the clear winners, benefiting from the Fed’s accommodative stance and improved export prospects. Notably, Natco Pharma surged 3.92% following a positive USFDA inspection report, while Biocon gained 2.27%. Similarly, IT stocks gained momentum on expectations of increased technology investments following the rate cut.

However, media and PSU banking sectors lagged, experiencing profit-booking after recent strong performances. Additionally, the broader market participation remained healthy, with Nifty Midcap 100 gaining 0.38% and Nifty Smallcap 100 rising 0.29%.

Trading Strategy for September 19, 2025 (Intraday + Swing)

Nifty 50 Strategy

Bullish Scenario: The primary strategy revolves around buying on dips above the 25,300 support level with initial targets at 25,500-25,550. Furthermore, a decisive break above 25,500 could trigger a rally towards 25,670 and eventually 26,000. Additionally, maintain a stop-loss below 25,275 for intraday trades.

Swing Trading Approach: For positional trades, consider accumulating quality large-cap stocks on any dip towards 25,350-25,300 levels. Target the 25,700-25,750 zone for swing positions with a stop-loss below 25,200. Moreover, the weekly closing above 25,400 would confirm the bullish structure for the coming week.

Bearish Scenario: A break below 25,330 could confirm a bearish reversal pattern, potentially leading to a decline towards 25,200-25,150. However, this scenario appears less likely given the current momentum and global cues.

Bank Nifty Strategy

Momentum Play: Bank Nifty presents an attractive buy-on-dips opportunity above 55,600 with immediate targets at 56,000-56,150. Subsequently, a breakout above 56,250 could open doors for 57,000-57,600 levels. Meanwhile, maintain a stop-loss below 55,400 for risk management.

Options Strategy: Consider Call option buying in 56000-56200 strikes for September expiry, given the strong momentum and low volatility environment. Alternatively, Put option selling at 55500-55600 strikes could provide steady income with limited risk.

Swing Approach: Bank Nifty’s 11th consecutive session of gains suggests strong underlying momentum. Therefore, any dip towards 55,500-55,600 presents a buying opportunity for swing traders with targets at 56,500-57,000 over the next 1-2 weeks.

Sector-Specific Recommendations

Pharmaceutical Stocks: Continue focusing on quality pharma names like Sun Pharma, Dr. Reddy’s, and Cipla. The sector’s 7-9% revenue growth projection for FY2026 provides a solid fundamental backdrop. Moreover, the recent USFDA approvals and improved export prospects support the bullish thesis.

IT Sector Strategy: Infosys, TCS, and HCL Tech remain attractive for both intraday and swing trades. The Fed’s rate cut typically boosts technology spending, benefiting Indian IT companies. Additionally, the sector’s resilient margins and steady dollar earnings provide stability.

For comprehensive market analysis and live signals, check our Free Buy-Sell Chart for real-time trading opportunities.

Risk Management Guidelines

Position Sizing: Limit individual positions to 2-3% of capital for intraday trades and 5-7% for swing positions. Moreover, diversify across sectors to reduce concentration risk. Additionally, avoid over-leveraging in the current low-volatility environment.

Stop-Loss Discipline: Maintain strict stop-losses at 1-1.5% below entry for intraday trades and 3-4% for swing positions. Furthermore, trail stop-losses as positions move in favor to protect profits.

Get our advanced TradingView Indicator for precise entry and exit signals.

Key Levels Table

| Index | Support 1 | Support 2 | Resistance 1 | Resistance 2 | Target |

|---|---|---|---|---|---|

| Nifty 50 | 25,300 | 25,150 | 25,500 | 25,670 | 26,000 |

| Bank Nifty | 55,200 | 54,800 | 56,000 | 56,250 | 57,000 |

These levels are crucial for September 19, 2025 trading. The support levels represent key areas where buying interest is expected to emerge, while resistance zones may witness profit-booking or fresh selling pressure. For high-probability trades with 2-5X profit potential, consider our Hero Zero Option Calls.

Final Thoughts

The Indian equity markets demonstrated remarkable resilience on September 18, 2025, extending their winning streak for the third consecutive session. The Federal Reserve’s 25 basis point rate cut provided the necessary catalyst for risk assets globally, while domestic fundamentals remained supportive.

Going forward, the combination of favorable global liquidity conditions, improving domestic earnings prospects, and strong institutional support creates a constructive environment for equity markets. However, traders should remain vigilant about any reversal signals near resistance zones and maintain appropriate risk management protocols.

The pharmaceutical and IT sectors appear well-positioned to benefit from both domestic growth and improved export competitiveness. Meanwhile, the banking sector’s 11-day winning streak suggests strong underlying momentum that could extend further.

For detailed market updates and expert analysis, visit reliable sources like Moneycontrol, Reuters, and Economic Times.

Disclaimer

This analysis is for educational purposes only and should not be construed as investment advice. Trading and investing in securities carries risk, including the potential for loss of principal. Past performance does not guarantee future results. Always consult with a qualified financial advisor before making investment decisions. The author and IntradayAFL.online do not assume any liability for trading losses incurred based on this analysis. Market conditions can change rapidly, and traders should conduct their own research and risk assessment before executing any trades.